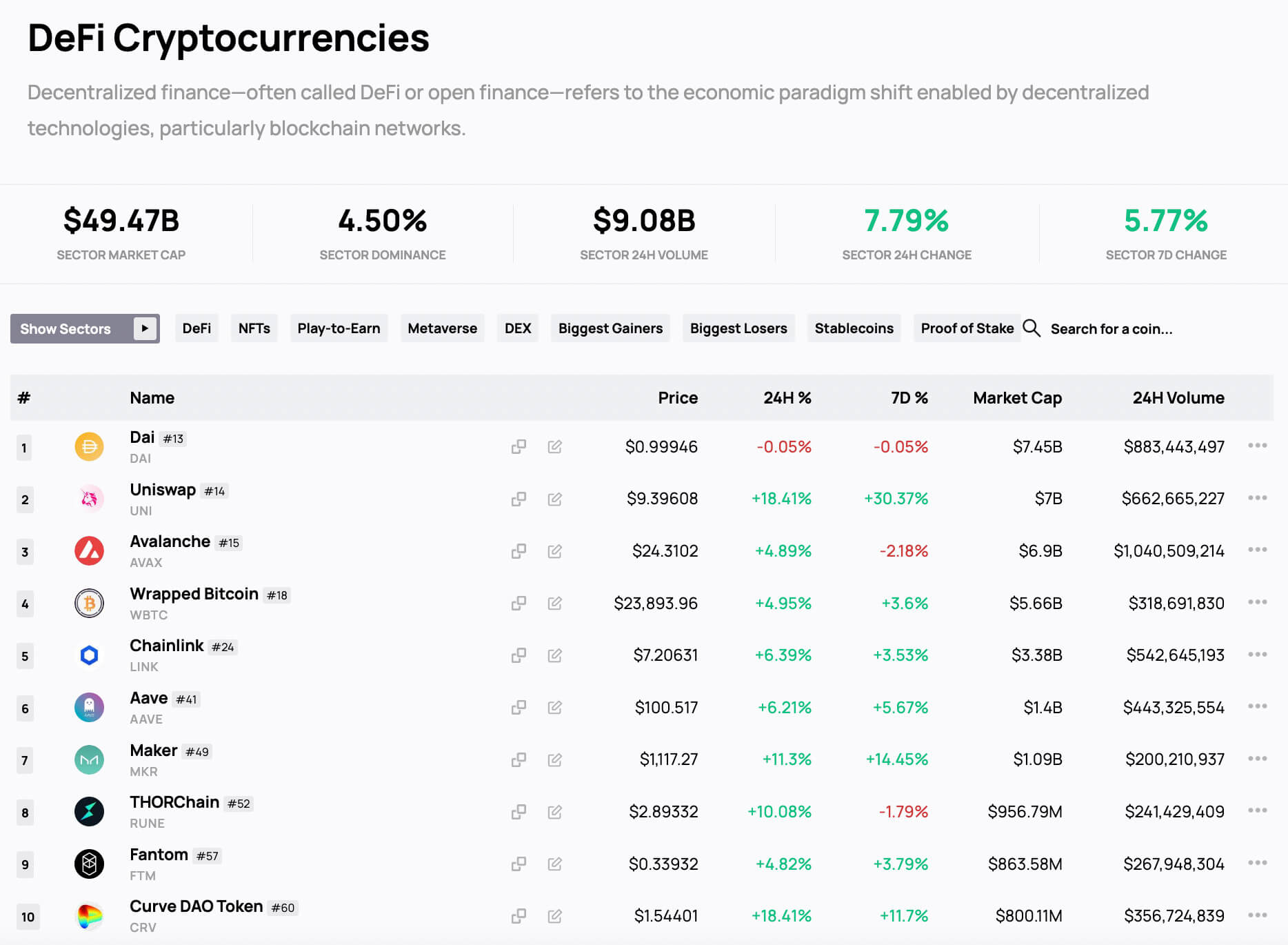

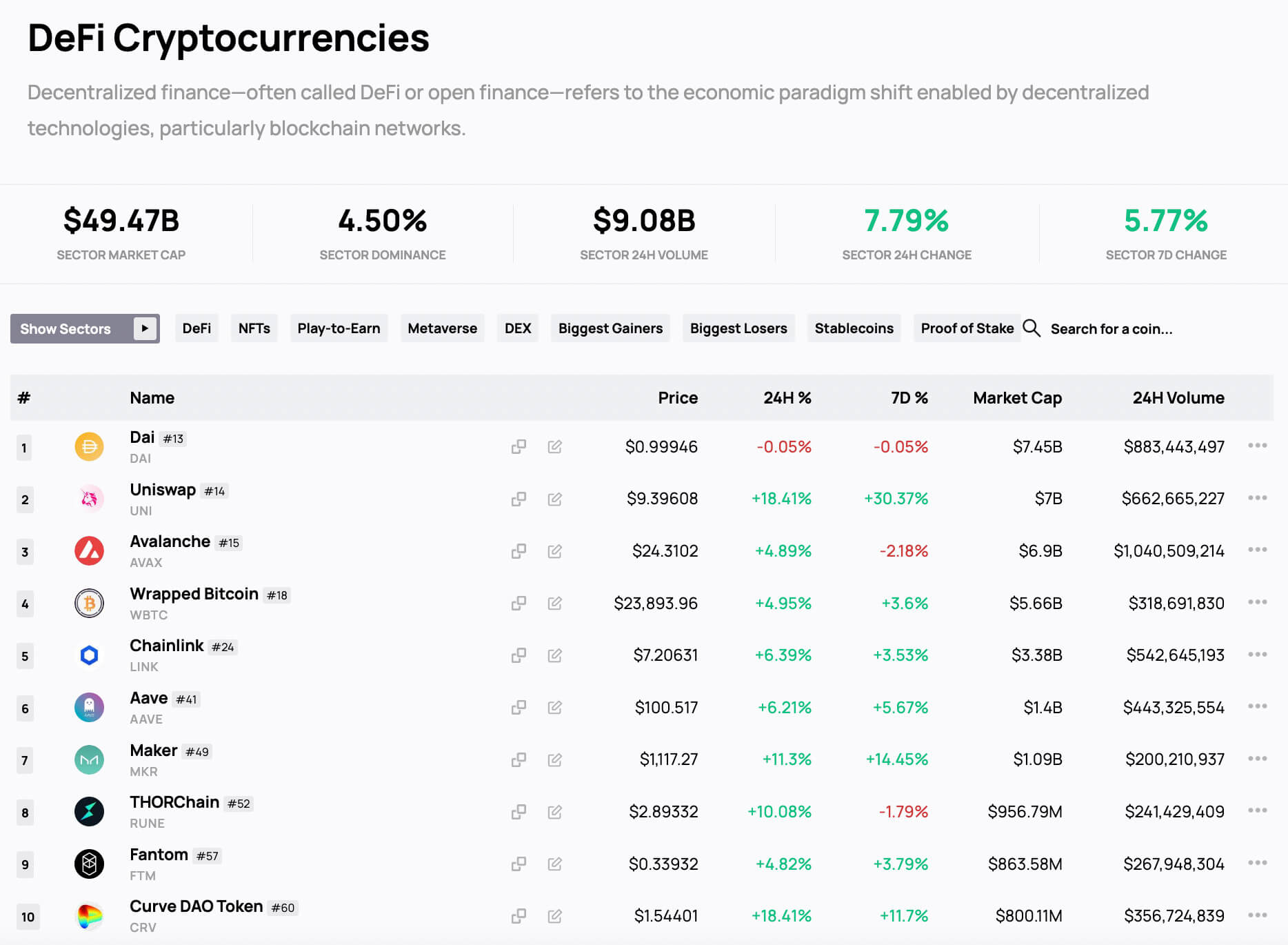

Following the surge in Bitcoin price, DeFi projects across the board are soaring on Thursday.

Bitcoin rose 15% following the FOMC meeting Wednesday and news of a technical recession on Thursday. However, the DeFi sector is seeing the most significant gains.

Out of the top 10 DeFi coins tracked by CryptoSlate, only ThorChain has been down over the past seven days. All coins and tokens are up between 10 to 56% in the past 24 hours.

Solend, a major Solana-based DeFi protocol, seems to think permissionless pools may kick start a DeFi Summer in 2022.

What are Permissionless Pools and why do they have the potential to kick off a new DeFi summer?

— 🙏🚫 Solend (we’re hiring!) (@solendprotocol) July 19, 2022

The protocol stated, “Permissionless Pools are isolated pools that anyone can launch. This allows long tail assets to be listed. Permissionless Pools share fees with the creator, enabling a new revenue stream for users.”

Hedera, the company behind the Hashgraph project, believe that sunglasses are to protect investors during their DeFi summer.

☀️Alright #HBARbarians – in celebration of @Hedera‘s #DeFi #NFT Summer and to offer our amazing community some protection from the heat, we’re giving away 10 pairs of Hedera SĦades! Put your knowledge to the test with the Q’s below for a chance to win – submit link @ end of the🧵 pic.twitter.com/rZGiZczRpt

— Hedera (@hedera) July 22, 2022

While DeFi analyst, LilMoonLambo, tweeted nine days ago that DeFi summer had already started and “few realize this.”

DeFi summer is happening again, right now.

Few realize this.

— LilMoonLambo (@LilMoonLambo) July 19, 2022

With the warmer weather coming for the western hemisphere as we move into August and a local high for Ethereum of $1,700 on Thursday, it could be easy to get carried away on the hopium. The DeFi summer of 2020 that marked the start of the last bull run took place in a vastly different world than the one we live in today.

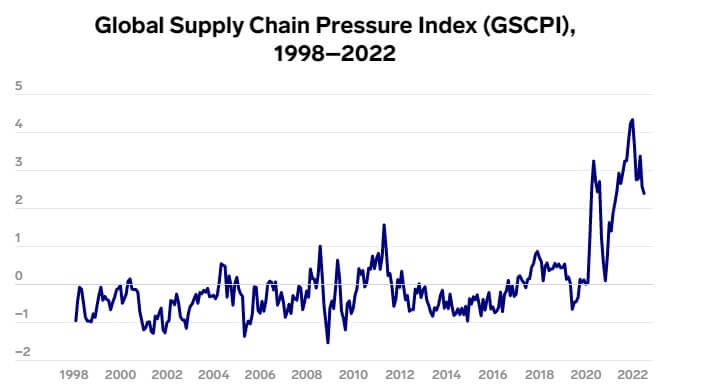

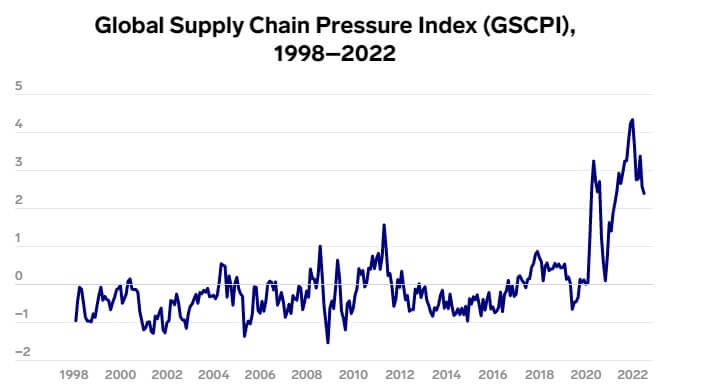

The first two quarters of 2022 have revealed a technical recession is present within the US, with other significant economies going through similar difficulties. War is still waging in Ukraine, and the supply chain issue is far from over.

However, an indicator posted by Business Insider indicates that pressure on the supply chain may be reducing. Pressure has been falling since the start of 2022 after reaching an all-time high at the end of 2021. Should problems with sourcing goods go away, the velocity of money should increase, thus removing stress from other parts of the global economy.

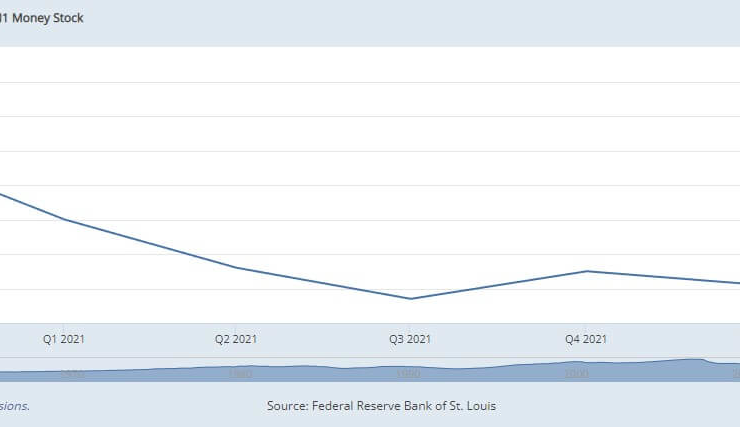

As this chart from the St. Louis FED reveals, the velocity of money is finally on the increase meaning more money is being spent in the economy compared to GDP. The M1 velocity of money is “calculated as the quarterly nominal GDP (GDP) ratio to the quarterly average of the M1 money stock.”

DeFi Summer should not be defined as a few warm days between July and September where DeFi tokens pump before crashing back to previous levels. It is incredibly early to be calling the current rally a DeFi Summer. However, the DeFi sector could undoubtedly be one to watch as Ethereum moves towards The Merge this September.

Comments (No)