One of the largest stockholders of the Coinbase cryptocurrency exchange has dumped a massive amount of shares as regulators reportedly probe the firm for alleged insider trading.

Cathie Wood’s investment firm Ark Investment Management has sold a total of more than 1.4 million Coinbase (COIN) shares, according to trading data compiled by Bloomberg.

The sale involved three Ark exchange-traded funds (ETF), including Ark Innovation ETF (ARKK), which offloaded a total of 1,133,495 shares, or 0.6% of the ETF’s total assets. Ark Next Generation Internet ETF and Ark Fintech Innovation ETF sold 174,611 and 110,218 COIN shares, respectively. Based on Tuesday’s closing price, the value of the sold shares amounted to slightly more than $75 million.

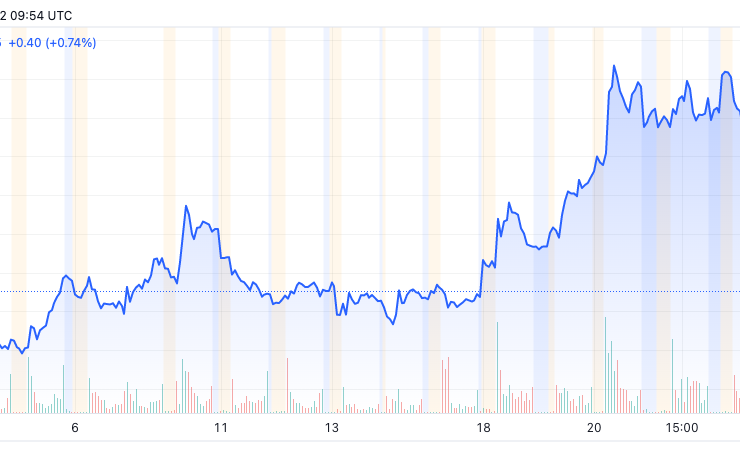

Coinbase stock closed at $52.9 on July 26, losing 21% of value amid the sale. After showing some signs of revival in mid-July, COIN has been tanking as U.S. authorities arrested a former Coinbase Global executive for alleged insider trading on July 21. Since reaching $77.3 on July 22, the Coinbase stock has lost about 32% at the time of writing, according to data from TradingView.

The sale came after Ark was steadily beefing up its COIN stash this year, buying 546,579 shares in Coinbase in May despite a drop in COIN shares. The investment firm has been actively buying COIN shares shortly after Coinbase debuted its stock last year, accumulating about 750,000 shares in April 2022. The stock originally opened at $350.

Related: Crypto firms facing insolvency ‘forgot the basics of risk management’ — Coinbase

According to a report by Bloomberg, Ark is the third-biggest shareholder of Coinbase, holding nearly 9 million shares by the end of June. The liquidation reportedly became Ark’s first sale of COIN this year.

Coinbase is reportedly facing a probe from the U.S. Securities and Exchange Commission (SEC) over the company’s potential involvement in crypto insider trading. SEC commissioner Caroline Pham expressed concerns that Coinbase might have improperly let Americans trade digital assets that should have been registered as securities.

Comments (No)