This is an opinion editorial by Adam Taha, an entrepreneur with two decades of government and corporate finance experience.

The latest consumer price index (CPI) print came out at a shocking 9.1% (9.8% in cities), and many speculators expected bitcoin’s price to “moon.” What happened was the opposite and bitcoin’s price action correlated with other risk assets. Many threw an expected tantrum and asked why? “I thought BTC was a hedge against inflation … when moon?”

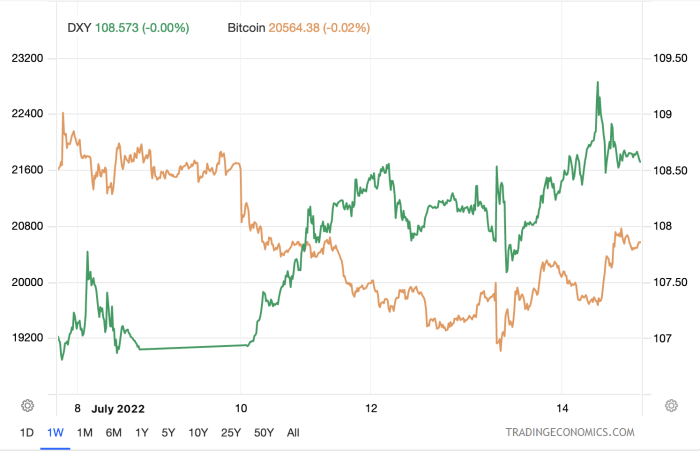

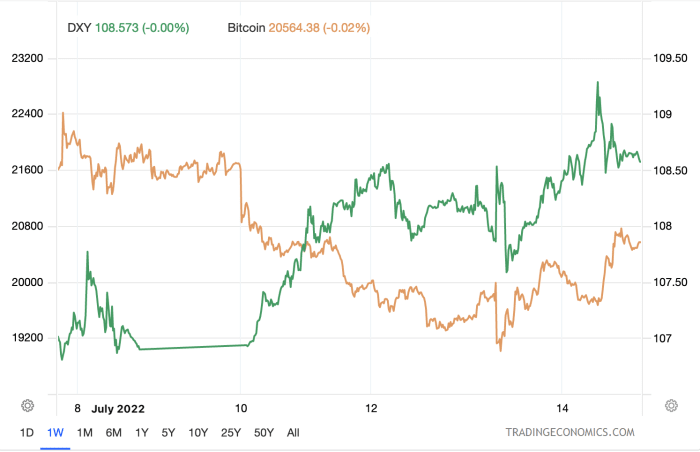

Keep in mind that bitcoin is a 13-year old resilient asset with just 13 years of network effect. How is it resilient? While the dollar, as we all know, has continued its meteoric climb, posting fresh yearly highs versus the British pound, euro, and Japanese yen year to date, making it a wrecking ball against most foreign currencies and risk-on assets. However, for the past week something incredible started happening: The price of bitcoin (in USD) has been keeping an extremely strong level of support as the dollar gains. This signifies a massively important event in my opinion.

Bitcoin’s price action frustrates some retail investors. That’s because the market is not dominated by retail. It’s dominated by institutional investors and “big money.” Institutions dominate the market but are themselves bogged down by rules, regulations and policies. As such, they view bitcoin as a risk-on asset and when inflation runs hot (latest print of 9.1%) then they go risk-off — especially when interest rates are high (“quantitative tightening” (QT) environment). Generally, “cash is king” is a common statement in traditional finance and the current fiat system for many investors. Institutions sell their risk assets (risk-off) and they buy cash (USD) and cash-flow equities when the DXY rises.

Note that gold and silver have significantly dropped in the last few weeks. So, what happened to their safe store-of-value proposition? Nothing. The proposition itself likely still holds. It’s not about the assets themselves, it’s about accumulating dollars right now. Having liquid cash is better for institutions and investors than having a valuable yet illiquid asset. Remember, institutions view cash as king in times of high inflation and QT.

To reiterate, Bitcoin is only 13 years old and it is taking time for retail and institutions to understand the true value of bitcoin. For now, institutional investors continue to view cash as king, and many people in retail still don’t understand what kind of money bitcoin is. So, for now we’re still stuck in the Federal Reserve Board’s monetary world.

The Fed’s policy is unsustainable. They know that, we know that. They can’t and won’t stop printing by adding liability to their balance sheets (debt to be paid off by future generations). What is the solution? Bitcoin is the solution. Sure, in two months cash will still remain king, but in two years cash will return to its original form: trash. Meanwhile, bitcoin will keep doing its thing and investors (both retail and institutions) will realize its value.

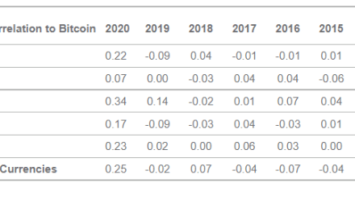

The following statement is relative: “Bitcoin is a hedge against inflation.” I say relative because for someone who bought bitcoin years ago (before 2017) that statement holds true. But for someone who bought recently, that statement is taken with some skepticism. Long term, it certainly is a hedge against inflation.

A credit default swap or CDS is an insurance instrument that institutions use when they own a bond issued by an issuer like a corporate or government bond. They can buy insurance against that bond failing (issuer defaulting). For institutions and investors, Bitcoin can and should be their CDS on the Fed failing. Bitcoin protects your wealth from debasement and it protects you like a CDS on the government. Bitcoin is your insurance policy against the government’s entire monetary policy and its “scam token” (aka the dollar).

The future is almost entirely digitized. Money will be no different. Bitcoin is without a doubt the only solution for a sound, immutable, secure, digital money that gives people their sovereignty. Banks are counterparties. Goldman Sachs, NYSE, Vanguard, Fidelity, and others are counterparties. With bitcoin, you own the asset outright and not the underlying asset. In today’s system, the reliance or hope is on the counterparty to uphold their end of the obligation and give what is owed to you when you need to liquidate an asset. Bitcoin flips this on its head using an elegant system of incentives, encryption, supply cap, decentralization, and a network that anyone can participate in.

Growing your purchasing power comes second. First, you have to protect that purchasing power. How do you protect your purchasing power? Bitcoin.

This is a guest post by Adam Taha. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Comments (No)