I. E-Cash Strikes Back

Thirty three years ago, the computer scientist David Chaum launched e-cash, a new way for people to spend digital dollars without revealing their personal information.

Users plugged their bank card into a terminal to deposit traditional digital dollars into Chaum’s bank — called DigiCash — which issued in return e-cash IOU tokens called “cyberbucks.” These tokens were bearer instruments, and could be traded privately across the internet between different e-cash users or spent on, for example, articles from “Encyclopedia Britannica.” When merchants redeemed the tokens in exchange for dollar deposits in their bank accounts, DigiCash was not able to link the redemption to the original deposit, thanks to a clever cryptographic concept Chaum invented called blind signatures.

In a blind signature scheme, secrecy is attained through a mechanism best explained by metaphor: Imagine a user walks into a bank and picks up a slip of carbon paper out of a box. Each slip has a unique number printed on the front. She seals the slip inside an opaque blank envelope and hands that, plus $100 in cash, to a teller, who signs the exterior of the envelope, transferring the bank’s signature onto the carbon slip inside. The bank does not know which exact slip was inside, but the user can leave the bank, remove the slip, and — voila — she now has an official promise to pay. She can swap this slip for cash or goods with others, or spend it at a participating merchant. When the time comes to redeem the slip for dollars, anyone can turn in the slip to a teller — who can verify the signature — but the bank does not know who made the initial deposit, nor does it know who made what transactions between deposit and redemption, giving users full privacy.

Chaum’s DigiCash issued “cyberbucks” that functioned like these carbon slips, except they were online virtual credits, exchangeable for dollars through banking partners. His early-1990s dream was that citizens could go about their daily lives and shop and transact without a growing Orwellian corporate state learning their every move.

Unfortunately, Chaum’s plan didn’t work. DigiCash was unable to gain traction as a regulated entity, and declared bankruptcy in 1998. Three years later, American and European officials responded to terrorist attacks in New York City on September 11, 2001 with a new wave of financial security measures. These “know your customer” (KYC) and “anti-money laundering” (AML) rules ended any chance that establishment banks could truly protect their customers’ financial privacy. The e-cash dream was dead.

Today, however, Chaum’s vision is being resurrected and upgraded, thanks to an unlikely alliance in the Bitcoin community.

II. Paralelní Polis

Last October, in a moment of serendipity, the software developer Eric Sirion ran into the Bitcoin exchange veteran Obi Nwosu at the Hackers Congress in Prague. The two had each spent many years in the Bitcoin community, and finally bumped into each other at an event hosted at Parallelní Polis. This is a café and event space in the Czech capital dedicated to Václav Havel’s revolutionary ideas of the parallel city: a place where citizens could interact freely underground, just as oppressive bureaucrats ruled their daily above-ground lives.

“We have new tools,” the Hackers Congress organizers proclaim on their website, “that allow us to create new cloud societies without the interference of coercive authorities.” It was a poetic place for Sirion and Nwosu to meet, as the two were working out an idea that could very well end up being one of the biggest breakthroughs in advancing Bitcoin’s mission to separate money from state.

Nwosu had run Coinfloor, a U.K.-based, bitcoin-only exchange, for eight years. In 2021, he sold the business, realizing that instead of being a jailbreaker and freeing people from the “handcuffs of fiat currency” by helping them access Bitcoin, he had become the jailkeeper, forcing them into compliance through regulation. “Another word for regulation,” he says, “is censorship.” He quit the corporate world and decided to set off on a mission to aid people worldwide through open-source code. He wanted to address the enormous global problem of financial exclusion by enabling people to access Bitcoin without going through megacorporations. The solution, he thought, would need to be “decentralized, de-identified, and dematerialized.”

This quest led him to Prague, where Sirion was finally coming into the public sphere, after years of laying low on the internet. A self-described introvert, Sirion had come across an idea so compelling that it drove him to become a more public person. “I finally had to create a Twitter account,” he laughs. He wears a mask when he speaks in public, but for a privacy introvert, going on stage even in disguise is a bold step forward. The idea that compelled Sirion to come out into the world was Fedimint: a portmanteau of federated Chaumian mint.

In 2015, Blockstream’s Adam Back and Greg Maxwell launched Elements, a Bitcoin sidechain that evolved into what is now known as Liquid. Here, Bitcoin users peg into a federated system that gives better privacy through Confidential Transactions. The federation allows users to peg out later back to Bitcoin. Liquid has not caught on as the creators had hoped, but the engineering behind it sparked an idea in Sirion’s mind: Could some of the technology behind Liquid be used to allow any group of people anywhere to spin up a federated Chaumian mint?

Unlike Chaum’s original vision of a company that would issue e-cash tokens, and run as a single point of failure, Sirion thought that Bitcoin’s programmable money could enable a federated alternative, where a group of users could control the mint and sign off on transactions through consensus. This way, instead of just one person being able to steal funds or cave to regulatory pressure, a majority would need to collude or give in. The consensus algorithm to achieve group approval of transactions would be a novel mechanism based on technology pioneered by Blockstream. Chaumian mints could vastly improve the privacy given by traditional custodians, and by adding federated control, the risk of theft could be significantly reduced.

As early as 2004, academics had proposed “multi-authority” e-cash schemes where issuance could be controlled by several issuers. Nothing was ever implemented, but Sirion thought Bitcoin could make it possible. Satoshi’s invention, Sirion says, “is the first asset in human history that can truly be held in a federated manner, only accessible if a certain quorum of people agrees. It is thus the perfect backing asset for a federated mint.”

Sirion’s goal is to improve default user privacy, which today, in Bitcoin, is not very good. Power users can achieve pretty good privacy, but the tradeoff is a lot of time and effort to use tools like JoinMarket or Whirlpool, and additional fees. Most Bitcoin users simply buy, store and sell on custodial platforms with KYC and AML constraints. When they withdraw their bitcoin, the address that receives the funds is known to the exchange, and thus, governments. But most people don’t consider this a problem, and would rather just do what’s easiest: go on Binance or Coinbase to buy or sell bitcoin.

Sirion thought that mobile Fedimint-powered apps could buck the trend and give people easy UX and powerful privacy. He was concerned that he might get “tarred and feathered” by the Bitcoin community for proposing a solution that made a tradeoff on self-custody, but ultimately thought improving privacy for the average user was worth it. Nwosu, meanwhile, had an entirely different reason to pursue the Fedimint idea.

III. From Bicycle To Jumbo Jet

For Nwosu, custody is the biggest challenge in Bitcoin today. Money and store of value are solved by Bitcoin’s main network and token. Payments are solved by the Lightning Network. But custody, he says, does not exist on a global scale.

Most Bitcoiners use custodial options and trust a corporation with their bitcoin. Maybe this is because few can afford or access a hardware wallet; maybe it’s because they find self-custody daunting; maybe it’s because they prefer to trust someone else. Either way, it means they are just holding promises to pay, and not the real thing. This is an urgent crisis in emerging markets, where the lion’s share of new users sign up for platforms like Binance, and end up simply paying exchanges for bitcoin credits. The real BTC, meanwhile, remain in the hands of megacorps, not the people.

Regulated institutions, Nwosu says, cannot be the future for Bitcoin, as they exclude vast swathes of the global population. “Billions of people won’t be able to use or access hardware wallets and won’t have the proper credentials to use exchanges,” he says. “Which means hyperbitcoinization — i.e., everyone being on a Bitcoin standard — is impossible.”

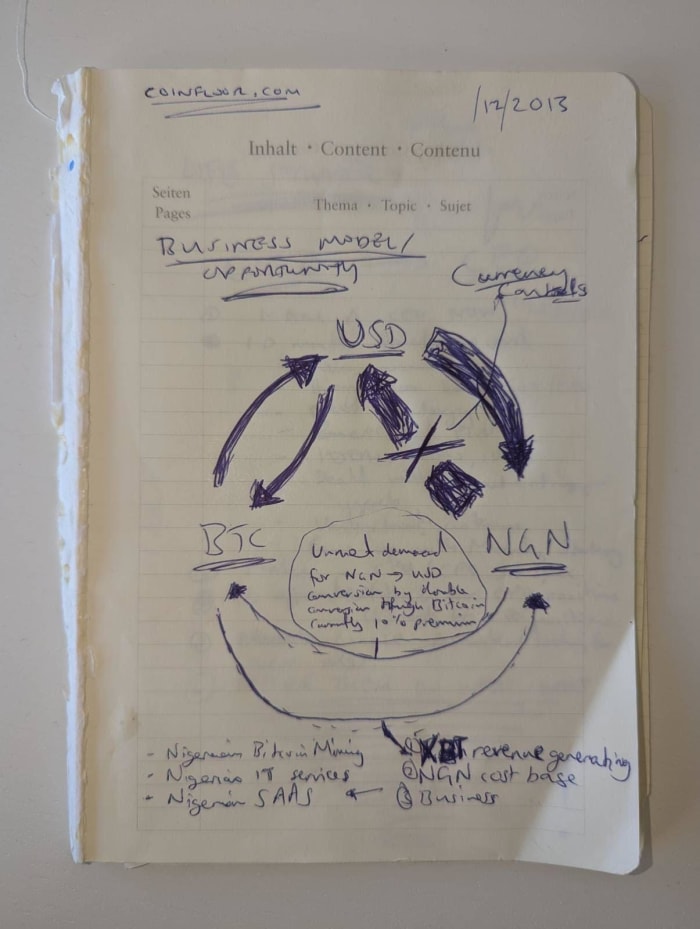

In Nwosu’s framework, custody is the “third pillar” of Bitcoin, alongside money and payments. His vision is to provide custody at scale for the likes of Nigerian society, something that he had always thought about during his days at Coinfloor. In fact, on his first day on the job he drew a diagram, connecting a bitcoin with a Nigerian naira. He’d always pondered how open-source money could empower people in Nigeria. But it was hard to do this in the true sense if people couldn’t afford hardware wallets or use privacy software.

When Nwosu heard Sirion’s idea, he had a eureka moment. Fedimints weren’t just a privacy upgrade: they were a way to solve the custody problem for emerging markets worldwide. On stage at the Bitcoin conference in Miami in April 2022, Nwosu joked that although it’s surprising to some in the West, people do trust their family and local communities in places like Nigeria. Fedimints, Nwosu thought, could take advantage of that community trust.

In Nigeria, an estimated 80% of all financial services are done through community or local mechanisms, where an individual trusts a local association to carry out savings, credit and commerce. Self-organized savings communities are already in place and trusted across Africa and the Caribbean: for instance the “tontine” in Côte d’Ivoire, “ekub” in Sudan, “jangi” in Cameroon, or “sou-sou” in Trinidad and Tobago. In Port of Spain, sou-sous have been used for more than 150 years, defined as “traditional African-derived plans of savings and pooling with a fixed set of participants in a revolving payment of collective deposits.” In Abidjan today, 600 women make up a tontine collective called CocoVico, where members pay in on a regular basis for the benefit of financial security. If the goal is to separate money from state and get bitcoin out of the hands of corporations, Nwosu thought, then community banks were an established way forward.

Fedimints are a provocative idea because they violate the first rule of Bitcoin: Not your keys, not your coins. This mantra is repeated by every serious Bitcoin user, who knows not to store their BTC on third-party exchanges. When used properly, Bitcoin should allow people to be their own banks. As this summer’s protests in Henan, China show, even in dictatorial regimes, people care deeply about their savings, and are willing to risk their lives to protect their earnings. The ability to be your own bank is a revolution.

Fedimint chooses a third way, between first-party custody and third-party custody. Nwosu calls it “second-party” custody: trusting friends, family or community leaders. In his Miami talk, he spoke of a “tribe-guardian” model, where like in days of yore, the strongest members of the tribe help the group. In this case, guardians are the technologically-strongest members of the tribe, who run Fedimint servers and provide trusted services to everyone else. For certain communities, guardians might even live in the diaspora. Nwosu argues that Fedimints upgrade the Bitcoin experience philosophically, structurally and technically through second-party custody, the tribe-guardian model and multisig.

With regard to recoverability, it’s possible for Fedimint users to back up their funds with a seed phrase, just like via a Bitcoin wallet. But, as Nwosu points out, then we’re back where we started with 12 words written down on a piece of paper, where one’s finances are physically vulnerable and not dematerialized. If a user is part of a community Fedimint, run by people she knows, she can elect to have her mobile app encrypt a backup to her guardians. If she ever loses her phone she can go to a quorum of the guardians, who start a recovery process, and she can get her funds back. This works because she trusts them with her funds anyway.

“In this case there’s no reason,” Nwosu says, “to also not involve guardians in the recovery process.” In his eyes, this is the big thing that might enable people to get off of exchanges. People use Binance today because they are worried about inheritance or losing a password. With community Fedimints, even if they mess up, they can still access their funds.

Today it’s common for Bitcoin users to own multiple or even many UTXOs. But, as Nwosu says, “we’re going to get to a point where everyone won’t be able to own their own UTXO.” To thrive past that point without megacorporations in control, a major innovation is needed.

“You can’t go directly from a bicycle to a rocket, or from a tent to a skyscraper,” he argues. “We need to change the model to get custody that can work for billions. And Fedimint isn’t designed for one person, it’s like a jumbo jet, designed for scale.”

Nwosu and Sirion are launching a company with developer Justin Moon to offer the first Fedimint mobile wallet. “Fedi” raised $4.2 million last week in a seed round to get started, and will use methodologies pioneered by the design firm Ideo “to ensure the final product incorporates human-centered design and is as simple and easy to use as possible,” per CoinDesk. The open-source work (repository here) will continue to be supported by organizations like Blockstream and the Human Rights Foundation. Sirion will focus on maintaining the open-source protocol and will take an advisory role with the company. Fedi, meanwhile, went live with a simple mission statement: “We build global Bitcoin adoption technology.”

IV. A Third Way

Community custody has already taken root in the Bitcoin community through custodial Lightning wallets. The Bitcoin Beach or Wallet of Satoshi apps are good examples. In the Salvadoran village of El Zonte, the local community often uses the Bitcoin Beach wallet to save and transact. It provides clean and simple UX with the speed and convenience of Lightning. Trusted community members hold the keys to user funds. But on the back end, one member ultimately custodies the funds between the hot and cold wallets and is a single point of failure. Wallet of Satoshi is also used frequently in emerging markets and is a popular app for many reasons. Spending with a custodial Lightning app is just as elegant as spending with something like Apple Pay. But again, it has a single point of failure. And in both cases, users do not have spending privacy from the custodians.

Privacy advocate Matt Odell calls the Fedimint idea a straightforward upgrade on custodial Lightning wallets, and says it’s “Signal for Bitcoin.” Privacy purists, he says, don’t like the fact that Signal requires the user to disclose a phone number, or the fact that users can’t run their own Signal servers. But ultimately, Signal has been able to expand communications privacy to tens of millions of users because the tradeoffs they’ve made prioritize convenience.

Casey Rodarmor left) and Eric Sirion (right) presenting behind a mask and glasses at Bitcoin 2022 in Miami

Sirion takes a similar tack. “I’m not building this primarily for people using Bitcoin in a self-sovereign way today,” he says. “If you are using your own hardware wallet, and running your own Lightning node, then maybe Fedimints aren’t for you. The actual target market is the much, much larger group of people using fully KYC’d, custodial solutions.”

Sirion says he recently visited El Salvador for the Adoption Bitcoin conference, and was “totally heartbroken” by how many people were just using the Wallet of Satoshi app. “The first hurdle,” he says, “is getting them off these totally centralized solutions.”

Odell says he “can’t count” how many videos there are of so-called “hardcore Bitcoiners” visiting places like El Zonte, using fully custodial apps. “We need to make tools that give people that same convenience,” he says, “while offering a better trade-off model.”

Bitcoin sovereignty exists on a spectrum, Odell says, from a state-run app like Chivo — where users have no say at all over their funds and could get frozen out at any time — to a power-user running their own Bitcoin and Lightning node and holding the keys to their funds. Today, the middle ground is served by apps like Bitcoin Beach or Wallet of Satoshi, but in his view, Fedimints could be a significant improvement.

In the end, even power Bitcoin users may find utility in Fedimints, if they use them like checking accounts. They might put small amounts of BTC into a Fedimint app, and use it to spend privately. And of course, power users with enough technical acumen to run infrastructure might find financial or moral reasons to act as guardians in local or global Fedimint systems.

Sirion points out that for community models — let’s say for a place like El Zonte, or picture your own neighborhood — privacy is of paramount importance. You don’t want your neighbor to know how much money you make, or have. In the Fedimint case, the user has privacy from the custodian, which lessens risk. Guardians do not need to know who is using the mint and cannot tell who exactly is transacting inside.

Nwosu explains that in third-party custody, the user has no privacy from the custodian, while in first-party custody, they have weak privacy from the public, as they are vulnerable to chain surveillance. But a lot of Fedimint transactions look the same on the blockchain as one normal transaction, protecting the individual.

Odell points out that today, because privacy is such a challenge, he sees a lot of users simply relying on exchanges for “spend” privacy: meaning, the merchant doesn’t know how much money you have if you pay them from Cash App but the exchange knows everything. Odell views this as a dangerous, slippery slope that, in a world where “99% of new users are coming in through regulated custodians and using custodial products.” Fedimints could help address.

Ultimately, Sirion doesn’t think users will choose privacy “for its own value” but with Fedimints they will receive privacy as an externality of seeking better UX, cheaper fees and an escape from the regulatory dragnet. “Privacy by default,” he says, “might be a way to defeat the KYC surveillance system.”

V. The Gateway

Perhaps the most powerful aspect of Fedimints is interoperability. If the idea takes off, there may be a mix of larger, more well-capitalized Fedimints that offer cheaper fees and certain advanced features, and smaller community Fedimints that are truer to the tribe-guardian model. Through the beauty of the Lightning Network, they will all be interoperable with each other and with every single other Bitcoin and Lightning user in the world. As Sirion says, “Having one mint is cool: having an internet of mints all connected by the Lightning network is way cooler.”

Without Lightning, Fedimints would be of limited utility, as users wouldn’t be able to easily switch between mints. This innovation is made possible through the “gateway,” a key part of Fedimint architecture. For internal transactions within Fedimints, these can be done easily and instantly via the software’s own consensus algorithm. But the true potential of Fedimints is in their ability to form a global network, powered by Lightning. In this arrangement, each Fedimint will have at least one, and possibly more than one, “gateway,” or Lightning service provider. These gateways could be run by the federation, or could be an independent economic actor, seeking fee revenue. In either case, it will process incoming and outgoing Lightning transactions on behalf of the mint for a fee.

Let’s fast-forward a few years into the future, and consider a Fedimint user that wants to buy coffee with their mobile app. The day before, they top up the app with $100 worth of BTC. Their app now shows the BTC-denominated balance from the moment of deposit. But on the backend, the BTC was actually sent through the app to a Fedimint-controlled address, and the federation issued the same amount of e-cash to the user. When she scans the merchant’s QR code with her phone to buy coffee, their app in the background sends the proper amount of e-cash credits to a gateway, which then pays out the Lightning invoice, all in seconds. During normal operations the gateway will accumulate a balance of e-cash and a separate balance of BTC. It will redeem the e-cash with the issuing mint on an ongoing basis, depending on cash flows. Gateways can provide services for more than one, and perhaps many, Fedimints. In fact, this might be normal. In this way, there can be thousands, millions or even billions of Bitcoin users, all using Fedimints, but only dozens, hundreds or thousands of actors running Lightning services.

Like with on-chain Bitcoin, it is hard to imagine the current Lightning Network servicing every single person in the world. It could take as long as three years to load all six-billion plus adults onto self-sovereign Lightning. And that’s assuming some technical improvements: Currently, it’s hard to imagine more than 100 million self-sovereign Lightning users even making just a few transactions per week. There are some potential future tweaks to Lightning like channel factories that could help people share UTXOs. But these require interactivity, not to mention a soft fork of Bitcoin. A billion self-custodial Lightning users is not currently a realistic scenario.

With Fedimints, there could be a constellation of well-capitalized power Lightning users acting as gateways, all servicing different customers. The network would feature more well-maintained, high-volume highways, and less haphazard grids of tiny, low-volume, poorly-maintained side streets. For those who live in places where the streets don’t work so well, they need a way to connect to the Lightning highway, without replicating a digital version of their own poor infrastructure.

Nwosu envisions tens of or hundreds of thousands of Fedimints, with at least a few thousand of major size, and says this is “orders of magnitude” more decentralized than today’s world, where just a few exchanges hold millions of bitcoin. Meanwhile, users get a “supercharged” Lightning wallet that provides strong privacy, liquidity and usability. Lightning and Fedimints may very well complement, enhance and strengthen each other.

Odell envisions a future where there are many different Fedimints competing with each other on uptime and fees. He sees them succeeding where Liquid has failed because instead of a single corporate federation, there are many federations, with full interoperability with other federations and the global Lightning Network. His view is that it is key to make it as easy as possible to spin up a Fedimint, whether they be pseudonymous global entities, or local, known, trusted community ones, or a combination of the two.

Since anyone can be a Lightning gateway, there’s no single point of failure. If one goes down (or gets shut down), a Fedimint could contract the services of another. In theory, Sirion says, the Fedimint doesn’t even need to choose. Users can work directly with gateways, setting up a future where there is a pool of gateways where users can choose who they want to work with. In practice, most Fedimint users would use the default option, but in theory, one could configure their own. Another bonus of Fedimints for Lightning’s future would be that the new need for gateways could increase the market for Lightning service providers, a lack of which is arguably holding adoption back.

What does it take to set up a Fedimint? The guardians need to each run a server. Sirion points out that it may not, for latency reasons, be efficient to run these servers over Tor. In the current framework, using Tor might slow the processing time down for transactions that should be instant to around two seconds. Which might be a good tradeoff for mints operating in authoritarian regimes, but not for ones elsewhere. In either case, users and gateways can easily run over Tor, helping mitigate privacy leaks.

Sirion hopes to be able to add blinded paths soon, so that the users, guardians and gateways know as little about each other as possible, further reducing censorship risk. If it ends up being possible to run a Fedimint server from cheap hardware at home over Tor, then, as Odell says, “We’re in business.” Either way, technically adept people — either for profit in a global market, or for the community in local markets — would run servers, empowering everyone else.

VI. Risks And Downsides

Fedimint critics are quick to point out that the compromise on self-custody is the main tradeoff and biggest risk of all, and that these new platforms could be used for a dizzying array of “rug-pulls,” where mint operators collude to steal funds from unsuspecting users.

Sirion does worry about a giant Fedimint attracting a huge number of users because of its cheap fees and liquidity and reliability, becoming a Mt. Gox-like systemic risk to Bitcoin. He also called Fedimint “much more complicated” than something like a custodial Lightning wallet like Bitcoin Beach, and points out that the fully-working end system merges Bitcoin, Lightning and novel federated consensus technology: a tricky mix.

There is also the philosophical controversy that Fedimint will spark in the Bitcoin community. Nwosu contrasts the traditional “don’t trust, verify” of Bitcoin with Fedimint’s “trust, but also verify.” Purists, again, may protest the concept. But they do not currently offer a solution to the global dominance of custodial solutions over non-custodial ones.

Another challenge arises when considering guardian incentives. Odell thinks there will be a mixture of people who run Fedimints for profit as businesses, and others who run them out of altruism for community or movement reasons. But the appetite to act as guardians or gateways for moral reasons remains to be seen. Separately, some raise the concern that Fedimint architecture could push the Lightning Network in a “hub-spoke” direction. Supporters say blinded paths — which will likely be implemented on several Lightning clients in the next 12 months — could address fears of censorship in this scenario by making it harder to tell who is paying whom.

Dario Sneidermanis, the creator of Muun Wallet, is a fan of the Fedimint concept, but fears they might be too similar to centralized exchanges in practice, with legal responsibilities (KYC), security risks (having a big pot of funds) and operational responsibilities (uptime and relationships with gateways). He says that the big exchanges are all using multisig anyway behind the scenes, so the concept may not move the needle on the current trade-offs.

Regulation certainly looms as a major challenge. As Odell points out, running the servers “is the riskiest part of the whole system.” The default project is open-source code, and is in the clear from a regulation perspective. But could individual Fedimints be considered money transmitters, for example, in the United States? In the West, could users run Fedimints without complying with KYC or AML laws? These are open questions. Some argue that it can be done so long as the Fedimint does not make a profit. The hope is this would exempt smaller community Fedimints from onerous regulation.

Odell points out the fact that Wallet of Satoshi doesn’t require KYC, and is a company based in Australia, an example of a “custodial” Lightning product that works just fine globally without overbearing financial bureaucracy, although he questioned whether it is compliant with regulations.

In any event, in authoritarian regimes and dictatorships — which constitute most emerging markets — Bitcoin use may be already legally limited or banned. For example, in Nigeria, citizens cannot connect their bank accounts to cryptocurrency exchanges, lest they get their funds frozen and financial services cut off. So the local exchanges operate in a peer-to-peer (P2P) model.

In this environment, using Bitcoin is already a crime. So running a Fedimint wouldn’t be any different. Fedimints could exist cross-jurisdictionally, with guardians in different countries, making individual Fedimints robust against state attacks. And if they could improve Bitcoin access to millions of people — where hardware wallets and Lightning nodes simply can’t scale — then maybe it’s the best way forward.

And if one day Bitcoin or Lightning engineering makes it possible for billions of people to easily self-custody their funds, then Fedimints wouldn’t be needed anymore, and would be phased out, having fulfilled a purpose as a bridge to the future.

VII. Beyond Banking?

What else can be done with Fedimints, beyond banking? Bitcoin developer Casey Rodarmor has noted that if they reach widespread adoption, they might displace much of the wider cryptocurrency world. Fedimints, for example, can act as “EVM”-style smart-contract computation nodes, and can execute any command in exchange for some satoshis.

Initially, according to Sirion, Fedimints will be limited to approximately 15 guardians. The larger the consensus set, the slower the system. But Sirion says it’s possible with future upgrades for a single Fedimint to boast more guardian signers than Ethereum or any proof-of-stake cryptocurrency has fully-validating nodes. This could make the Fedimint ecosystem more robust and decentralized than alternative blockchain solutions.

So, want digital U.S. dollar cash on your mobile wallet? Want to chase yield? Want to mint and trade tokens? It might be better and more robust, in the long run, to do this on Fedimints than on novel Layer 1 blockchains.

Today, bitcoin “credits” might be created through a KYC’d system like wBTC, where users send bitcoin to a centralized issuer like BitGo, in exchange for ERC-20 “wrapped bitcoin” tokens. Rodarmor explains that instead, users could freely send bitcoin to a Fedimint in exchange for tokens, and then the federation could run whatever logic it wanted. Sirion says the Fedimint codebase currently relies on smart contracts to interact with gateways, but could in the future support tokens, domain names and more.

Stablecoin functionality, at the very least, could be extremely useful for emerging markets, where demand for dollars is high. Sirion says it’s possible and even likely that first-generation Fedimints enable users to deposit BTC or tether, and have both balances on their app. Then they could choose to spend or redeem either at any point.

Taro, he says, could supercharge this ability, allowing stablecoins like tether to be traded over the Lightning Network. This would give Fedimint users the ability to save and spend in bitcoin or dollars instantly anywhere in the world, bringing the masses one step closer to global financial freedom and equality of opportunity.

Bernard Parah runs a Bitcoin exchange called Bitnob in Nigeria. He has worked on the company full-time since 2018, after spending several years helping people informally move money back and forth from Ghana to Nigeria using BTC as a remittance rail.

Bitnob is a bitcoin-focused exchange amongst a sea of companies that resemble digital casinos, offering hundreds or thousands of different tokens to users. Parah says the focus helps keep things simple and helps his customers avoid scams.

Today, when one uses the Bitnob app, they deposit naira from their bank account and receive bitcoin or dollars (via Tether) in a way that’s just as seamless and easy as a banking app. On the backend, what’s really happening is that the user is sending a wire to a broker, who is then sending bitcoin to Bitnob, or vice versa. Bitnob’s main product is a “dollar-cost averaging” (DCA) savings platform, where users “top up” their account with naira and then buy into bitcoin bit by bit over time until the balance is exhausted. They also offer payment cards (where users exchange stablecoins for dollar-denominated Visa or Mastercards which can be spent anywhere globally) and a credit service, where users can borrow up to 50% loan-to-value against their bitcoin as collateral. This, Parah says, is popular for small businesses in Nigeria that have some BTC on their balance sheets.

Twice as many Nigerians are born each year as Europeans. A 218 million person-strong country, Nigeria is on pace to exceed the population of the United States in the next 25 years. And millions of Nigerians are using cryptocurrency, with droves more joining every day. Bitnob was the first African exchange to integrate the Lightning Network, a choice made to help users send and receive value instantly anywhere in the world. Parah has a frontrow seat to Bitcoin adoption in emerging markets, and is on the frontier of integrating the latest technology, making him uniquely qualified to assess the potential of Fedimints.

This is why it’s important to heed Parah’s perspective when he cautions that even though his app reminds users to withdraw to self-custody once they exceed $1,000 on their platform balance, only 10% to 20% of his customers actually do so. 80% to 90% do not, choosing to rely on the convenience of the app.

Parah thinks Fedimints could be a game changer. He doesn’t necessarily view them as something for power users, but as an upgrade for the masses. Parah is in touch with Sirion and Nwosu’s team, and is excited to offer the service to his customers. He is “reassured” that Nwosu is helping to lead the movement, as Parah says, “He’s big on freedom… He’s not in it to make money, he’s in it to fix the money.”

Parah thinks Fedimints will appeal to people if they can integrate into their pre-existing systems of trust. In a place like Nigeria, seeking privacy or avoiding KYC are not motivating factors. In fact, he jokes, when a company doesn’t do KYC, people get worried. But he thinks if explained correctly, many of his clients will be interested in Fedimints as a way of leveraging a social strength. “Trust is important,” Parah says. “This is how communities work. We talk a lot in Bitcoin about trustlessness, but ultimately, here, trust is an essential part of our society.”

And existentially, he doesn’t think Bitcoin and Lightning can meet the needs of Nigeria, or the world, on their own. Already, he’s seeing the challenges of custody. If only 10% to 20% of his customers are taking control of their funds, he can only imagine how few of Binance’s Bitcoin customers are being their own bank.

“This is why we need Fedimints working,” he says, “as soon as possible.”

Fedimints may even prove valuable to the global hawala system, which settles $250 billion every year. An ancient technology of trusted broker networks popular in the Muslim world, hawala operators (known as hawaladars) could join forces and create their own Fedimints, reducing fees for users and reducing counter-party risk among each other. Hawaladars already exist parallel to the state financial system, and some are beginning to adopt Bitcoin, so this might be a good fit, especially in countries like Nigeria with a 50% Muslim population. The same could be said for sou-sous, which are popular in West Africa and the Caribbean precisely because their users have trouble accessing the financial system: perhaps these collaborative savings pools could be early Fedimint adopters.

Nwosu can’t wait to get started. He expects early versions of Fedimint wallets to be live later this year, in time for the first Bitcoin and Lightning conference in Africa, to take place in Accra on December 7 to 9, 2022. The event could be a tipping point for Bitcoin builders and educators to learn more about the challenges of the average global user. It could also be a touchstone for the trajectory of Fedimints.

“Once you grasp the idea and get over the hangups on the trust model,” Nwosu says, “you realize this is the missing piece for Bitcoin. It obsoletes the altcoins, provides better privacy than Monero, offers better off-chain scaling than ZK rollups, gives better UX than any exchange, and could get closer to the security gold standard of hardware wallets.” There will be skeptics, but Nwosu’s arguments and conviction are hard to shake.

In December 2010 Hal Finney wrote that “There is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, redeemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient… Bitcoin-backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others. I believe this will be the ultimate fate of Bitcoin, to be the ‘high-powered money’ that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers. Bitcoin transactions by private individuals will be as rare as… well, as Bitcoin-based purchases are today.”

Maybe Finney’s “bitcoin banks” were not Coinbase or Binance after all, but rather, a global network of Fedimints.

This is a guest post by Alex Gladstein. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)