The total crypto market capitalization broke above $1 trillion on July 18 after an agonizing thirty-five-day stint below the key psychological level. Over the next seven days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a 0.5% correction to $1,560.

The total crypto capitalization closed July 24 at $1.03 trillion, a modest 0.5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and the $150 billion value of stablecoins. The broader data hides the fact that seven out of the top-80 coins dropped 9% or more in the period.

Even though the chart shows support at the $1 trillion level, it will take some time until investors regain confidence to invest in cryptocurrencies and actions from the United States Federal Reserve could have the largest impact on price action.

Furthermore, the sit and wait mentality could be a reflection of important macroeconomic events scheduled for the week ahead. Broadly speaking, worse than expected data tends to increase investors’ expectations of expansionary measures, which are beneficial for riskier assets like cryptocurrency.

The Federal Reserve policy meeting is scheduled for July 26 and 27, and investors expect the United States central bank to raise interest rates by 75 basis points. Moreover, the second quarter of U.S. gross domestic product (GDP) – the broadest measure of economic activity — will be released on July 27.

$1 trillion not enough to instill confidence

Investors sentiment improved from July 18, as reflected in the Fear and Greed Index, a data-driven sentiment gauge. The indicator currently holds 30 out of 100, which is an increase from 20 on July 18 when it hovered in the “extreme fear” zone.

One must note that even though the $1 trillion total crypto market capitalization was recaptured, traders’ spirits have not improved much. Listed below are the winners and losers from July 17 to 24.

Arweave (AR) faced a 20.6% technical correction after an impressive 58% rally from July 12–18 after the network file-sharing solution surpassed 80 terabytes (TB) of data storage.

Polygon (MATIC) moved down 11.7% after Ethereum co-founder Vitalik Buterin supported the zero-knowledge Rollups technology implementation, a feature currently in the works for Polygon.

Solana (SOL) corrected 9% after the demand for the smart contract network could be negatively impacted by Ethereum’s upcoming migration to a proof-of-stake consensus.

Retail traders are not interested in bullish positions

The OKX Tether (USDT) premium is a good gauge of China-based retail crypto trader demand. It measures the difference between China-based peer-to-peer (P2P) trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded and causes a 4% or higher discount.

Tether has been trading with a slight discount in Asian peer-to-peer markets since July 4. Not even the 25% total market capitalization rally durinJuly 13–20 was enough to display excessive buying demand from retail traders. For this reason, these investors continued to abandon the crypto market by seeking shelter in fiat currency.

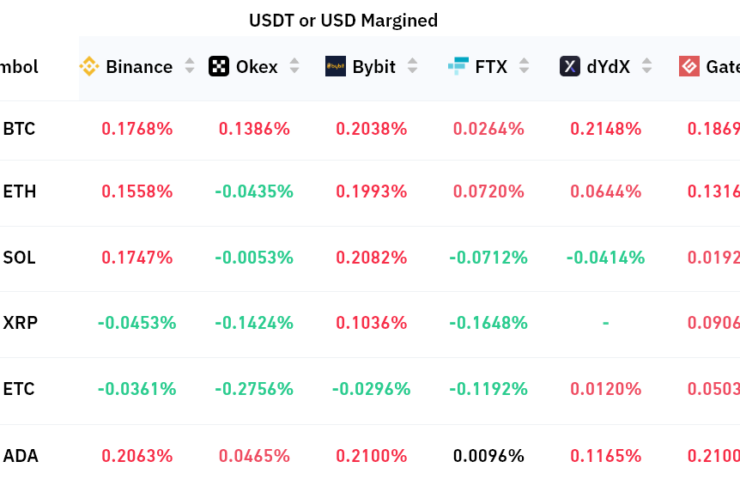

One should analyze crypto derivatives metrics to exclude externalities specific to the stablecoin market. For instance, perpetual contracts have an embedded rate that is usually charged every eight hours. Exchanges use this fee to avoid exchange risk imbalances.

A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The derivatives contracts show modest demand for leveraged long (bull) positions on Bitcoin, Ether and Cardano. Still, nothing is out of the norm after a 0.15% weekly funding equals a 0.6% monthly cost, so uneventful. The opposite movement happened on Solana, XRP and Ether Classic (ETC), but it is not enough to raise concern.

As investors’ attention shifts to global macroeconomic data and the Fed’s response to weakening conditions, the window of opportunity for the cryptocurrencies to prove themselves as a solid alternative gets smaller.

Crypto traders are signaling fear and a lack of leverage buying, even in the face of a 67% correction since the November 2021 peak. Overall, derivatives and stablecoin data show a lack of confidence in $1 trillion market capitalization support.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Comments (No)