Trend forecaster Gerald Celente told Bitcoin.com News that “World War III has begun,” weighing in on Covid-19, crypto, the Great Reset, and gold in an exclusive interview. Jordan Belfort, aka the Wolf of Wall Street, talked long-term BTC investing, as scorching inflation in the U.S. continues to plague Americans, though Biden’s White House says the latest numbers are “out-of-date.” All this and more in your bite-sized digest of this week’s hottest stories from Bitcoin.com News.

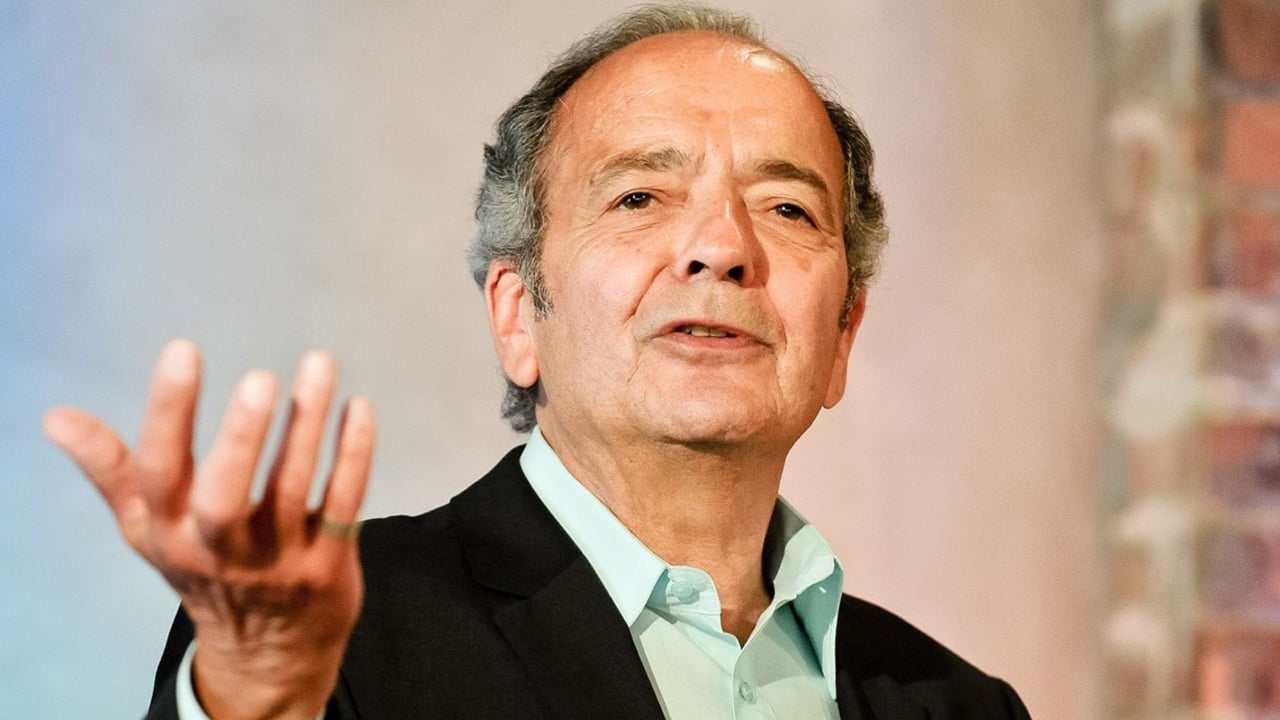

Trend Forecaster Gerald Celente Says World War 3 Has Begun — ‘If the People Don’t Unite for Peace, We Are Finished’

This week Bitcoin.com News spoke with Gerald Celente, the popular trends forecaster, and publisher of the Trends Journal. During a telephone conversation, Celente discussed the uncertainty surrounding the global economy after governments worldwide locked down the world’s citizens over the Covid-19 pandemic, shut down businesses and injected trillions into the economy.

The discussion touches upon gold, bitcoin, the pandemic, the Ukraine-Russia war, and the Federal Reserve. The trends forecaster believes that World War III has already begun, and if people do not assemble to bolster peace in this world, then we the people are doomed. Celente stressed that if people want real change, they cannot rely on hope as they need to take a stand to make it happen themselves.

‘Wolf of Wall Street’ Jordan Belfort Says He’d Be Shocked if You Didn’t Make Money Investing in Bitcoin Long Term

Jordan Belfort, aka the Wolf of Wall Street, says if you take a three, four, or five-year horizon, he would be shocked if you didn’t make money investing in bitcoin because the underlying fundamentals are really strong.

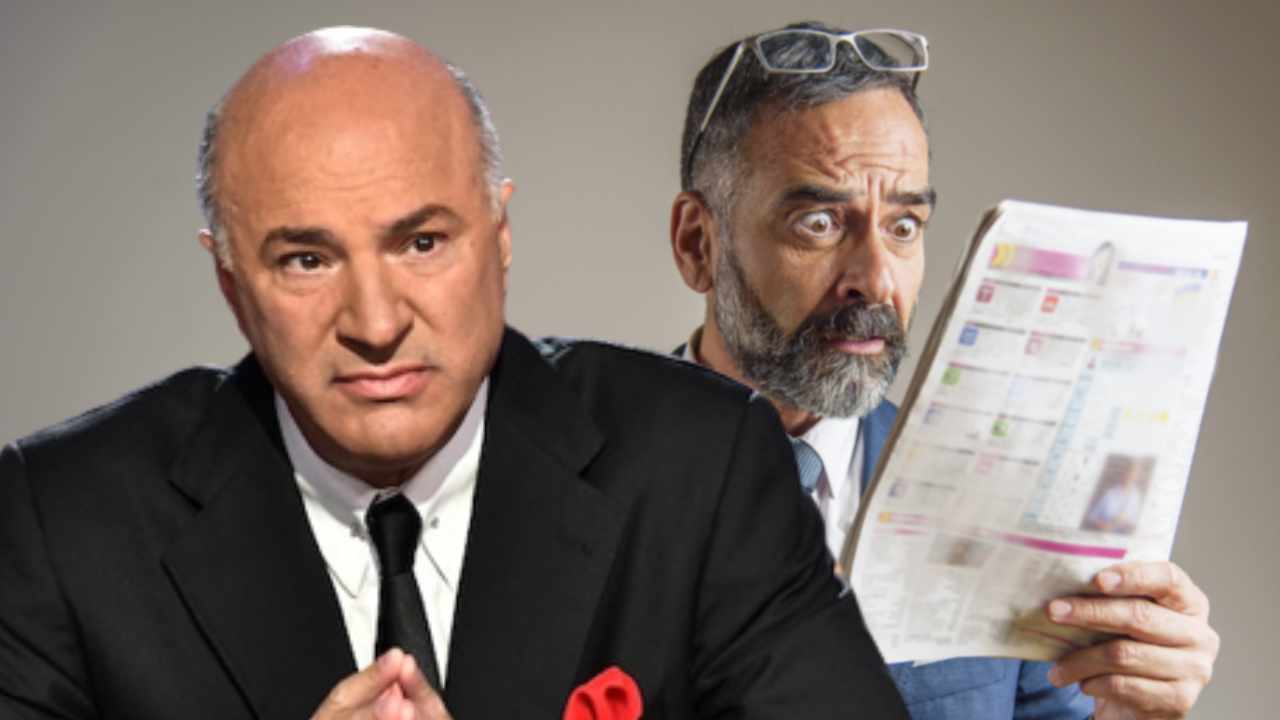

Kevin O’Leary Warns Major Crypto Panic Event Is Coming — ‘I Don’t Believe We’ve Seen the Bottom Yet’

Shark Tank star Kevin O’Leary, aka Mr. Wonderful, has warned of an impending “big panic event” in the crypto space. “I don’t believe we’ve seen the bottom yet and I have a different view of it,” he said.

US Inflation Remains Scorching Hot, Jumping to 9.1% in June — White House Says CPI Data Is Already ‘Out-of-Date’

According to the latest Bureau of Labor Statistics Consumer Price Index (CPI) report, U.S. inflation remains scorching hot as it has risen at the fastest yearly rate since 1981. June’s CPI data reflected a 9.1% year-over-year increase, even though a number of bureaucrats and economists thought May’s CPI data would be the record peak.

What are your thoughts on this week’s hottest stories from Bitcoin.com News? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)