The below is a direct excerpt of Marty’s Bent Issue #1337: “Ignore the unproductive central planners.” Sign up for the newsletter here.

(Source)

The unproductive class is doing its best to ruin the global economy. This class is made up of politicians, bureaucrats and central bankers that have been enabled by a global administrative state expanding at an ever-increasing pace since the end of World War II. Those individuals who make up the unproductive class do not produce anything of value for the world despite what they would like you to think, which is that they are an essential part of order in the world. In fact, the unproductive class should probably be more aptly described as the counterproductive class as everything they do seems to create friction for those who actually bring valuable productive skills and expertise to the world.

Hell, it has even gotten to the point where it isn’t a far fetched idea to believe that the unproductive class is actively being counterproductive in an attempt to push the masses into a fearful and desperate state that would make them more susceptible to being manipulated to act against their short- and long-term best interests. Your crazy Uncle Marty has reached this conclusion. One can only witness so many coincidental “incompetent blunders” in a row over the course of several years before beginning to grow suspicious that something nefarious is afoot.

Forced lockdowns.

Printing trillions.

Normalizing masks, which have been proven not to work.

Mandating experimental vaccines.

Energy policy that decreases availability and reliability while increasing costs.

Food policy that leads to shortages.

When isolated, it is easy to write each off as a policy mistake that anyone could have made in the heat of the moment. However, when you take a step back and consider that these policies across different domains have been flung at the public at an incredible pace and in conjunction with one another globally, it is extremely hard to come to any other conclusion besides there is a coordinated effort to completely restructure society in the eyes of those in power: the unproductive class of psychotic central planners. If the unproductive class that is coordinating on an international level, control the money, the energy, the food and eliminate bodily autonomy, they will have successfully subjugated the world.

Don’t look now freaks, but the unproductive class does have a high degree of control over all of those things at the moment. I would argue that we have already been subjugated. The masses of men do not find themselves in a position where they need to figure out how to defend against a looming subjugation. They find themselves in a position where they better recognize they have been subjugated and work quickly to break free while the door to freedom is still cracked and in a position where it can be kicked open with a bit of effort.

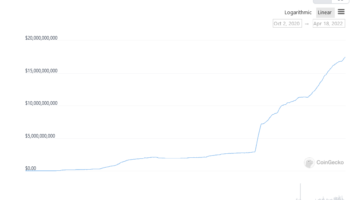

Bitcoin is the wedge that is keeping the door cracked and the more prominent it becomes, the higher the chances that the masses of men will escape subjugation by the unproductive class. The power over the money is the base from which the unproductive class operates. If one has the central authority to create and destroy monetary units and decide who can and cannot receive or send those monetary units, they can essentially centrally plan an economy. Bitcoin allows us to rip that central control away from the unproductive class. This is just the first step, though.

To fully cut the unproductive class away from the levers of control, the productive class must begin to secure the layers outside of money using bitcoin. One of the highest layers and easiest to disrupt is energy. Bitcoin mining provides many avenues by which energy producers can begin to pry themselves away from the unproductive class wielding the money printer. The easiest way to do so is by monetizing their stranded energy directly via bitcoin mining.

By converting previously wasted resources to censorship resistant hard money, energy producers can begin to bolster their balance sheets in a worst case scenario — buy relatively expensive ASICs during at the peak before a bear market — and supercharge them or, in a best case scenario — buy relatively cheap ASICs at the bottom before a bull market. Increasing the efficiency of your assets is always a good thing, but it’s a great thing when that efficiency (in this case, utilizing previously underutilized assets) brings increased profits. This is step one.

Step two kicks in when energy producers realize the power of the Bitcoin network and begin to demand that they get paid in sats for selling their precious energy resources to the market. When this happens, the script will be completely flipped on the unproductive class. With the insanity of ESG mandates increasing as time goes on, the likelihood of this script flipping increases.

It is not hard to see an attack on energy producers from the unproductive class pushing insane ESG mandates on the markets where they begin to try to freeze the bank accounts of producers who decide not to play along with the madness. If and when this point is reached, it will probably instill a ton of fear in these energy producers, but they should not fear. They have leverage on their side because they produce energy, which is vital for human flourishing. As we’re discovering rather quickly, when energy supply chains break down, it has dire consequences. When push comes to shove, the smart humans will begin to ignore the unproductive class and attempt to acquire the energy they need in any way possible. Luckily for those smart individuals Bitcoin exists and it is there to offer them a censorship resistant network through which they can settle energy trades. Sats for power will become the norm.

It would be nice if it didn’t reach this point, and the best way to prevent it from getting to that point is for energy producers to frontrun the censorship by beginning to settle their trades in sats instead of cuck bucks. The question that remains is: How quickly is the productive class going to take initiative and preemptively remove the unproductive leeches from the equation?

Comments (No)