Crypto exchange Coinbase plans to expand its operations in Europe and is actively registering in key European countries, including Italy, Spain, France, and the Netherlands, Bloomberg News reported June 29.

On June 13, the firm said it would cut 1,100 U.S. workers, representing 18% of its workforce, citing the importance of staying lean during recessionary times.

Before the job cuts were announced, staff had criticized the company’s poor performance in an online petition that has since been deleted. The petition called out several senior execs, a move Coinbase co-founder Brian Armstrong said was “really dumb on multiple levels.”

Coinbase to expand in Europe

Despite the recent bearish price action in cryptocurrencies, Coinbase’s Vice President of Business Development and Internation, Nana Murugesan, said the company plans to increase its European presence at both the retail and institutional levels.

“In all these markets our intention is to have retail and institutional products.”

Murugesan noted that the company has hired its first employee in Switzerland and added that, as valuations have plummeted in the sector during the downturn, it will consider acquisitions that will speed up the expansion plans.

The downturn continues

The price of cryptocurrencies has sunk recently due to several factors, including scandals at Terra and Three Arrows Capital, which come on top of harsh macroeconomic conditions.

Investors continue fleeing to dollars, as evidenced by a 1.2% spike in the DXY since June 27.

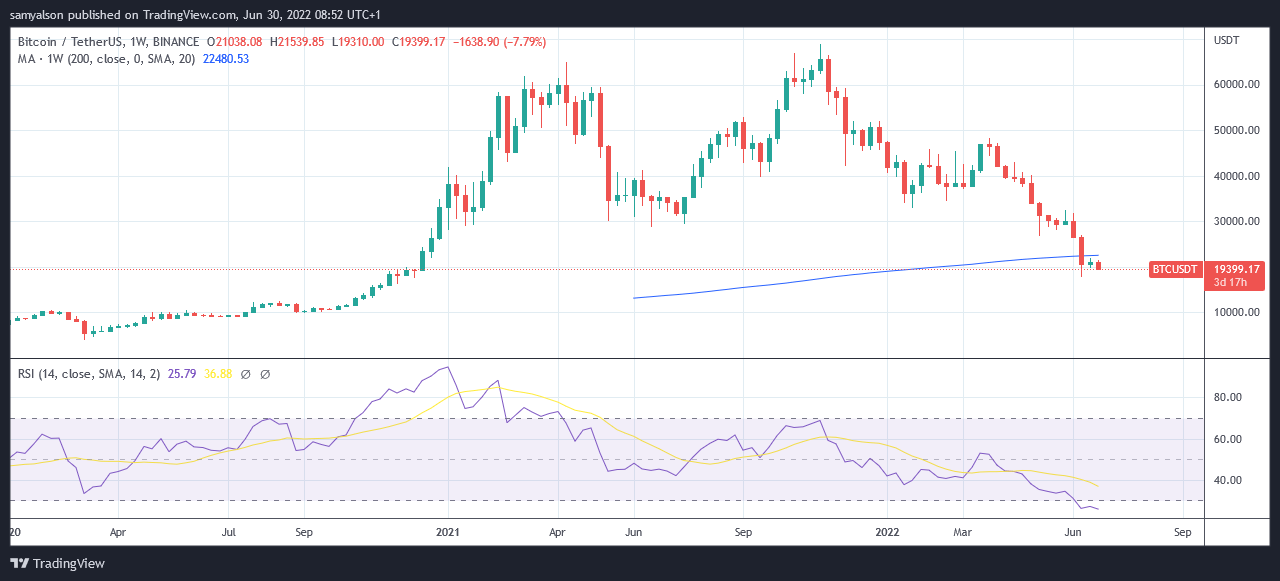

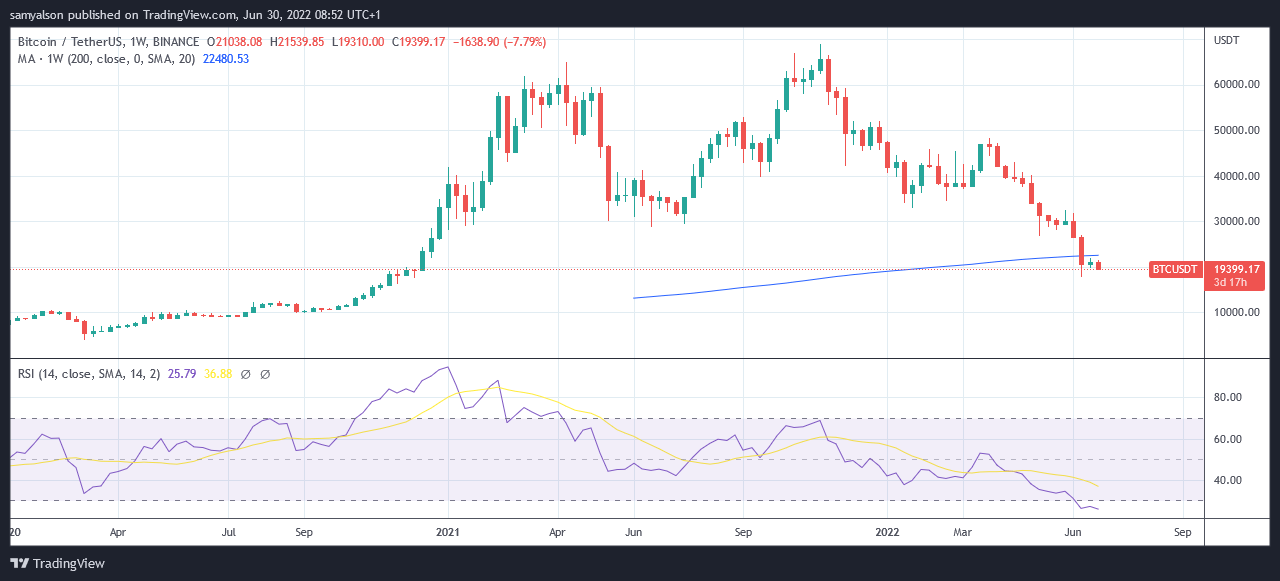

Meanwhile, the market leader, Bitcoin (BTC), went below the psychologically important $20,000 level on June 29. Analysis of the 200-day moving average shows BTC is on track to close three consecutive weekly candles below this level – an event that has never happened before.

The 200-day moving average represents the average price of the last 200-days (or 40 weeks) and is considered a key indicator for calculating long-term trends.

Goldman Sachs says COIN is a sell

The Coinbase stock price did not respond to the announcement, trading flat to close the June 29 trading day down 1.4%, at $49.75. Meanwhile, year-to-date losses for COIN come in at -80%.

On June 27, investment banking firm Goldman Sachs downgraded Coinbase’s stock from neutral to sell, adding that expenditure outflows remain a concern.

Coinbase expects its Q2 monthly transacting users and total trading volume to decline from the previous quarter. The Q2 report is scheduled for Aug. 9.

Comments (No)