This is an opinion editorial by Jordan Wirsz, an investor, award-winning entrepreneur, author and podcast host.

Bitcoin’s correlation to inflation has been widely discussed since its inception. There are many narratives surrounding bitcoin’s meteoric rise over the last 13 years, but none so prevalent as the debasement of fiat currency, which is certainly considered inflationary. Now Bitcoin’s price is declining, leaving many Bitcoiners confused, as inflation is the highest it’s been in more than 40 years. How will inflation and monetary policy impact bitcoin’s price?

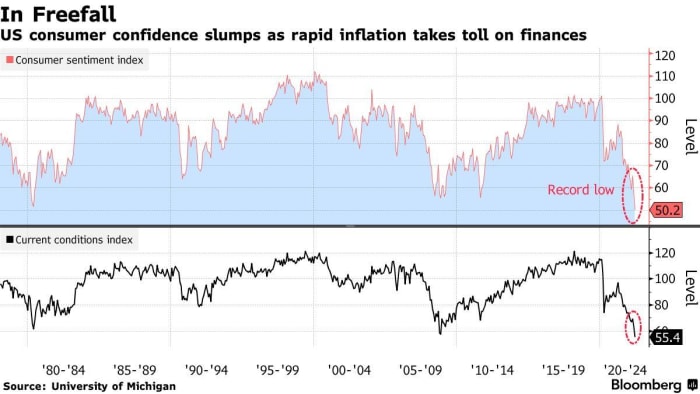

First, let’s discuss inflation. The Federal Reserve’s mandate includes an inflation target of 2%, yet we just printed an 8.6% consumer price inflation number for the month of May 2022. That is more than 400% of the Fed’s target. In reality, inflation is likely even higher than the CPI print. Wage inflation isn’t keeping up with actual inflation and households are starting to feel it big time. Consumer sentiment is now at an all-time low.

(Source)

Why isn’t bitcoin surging while inflation is running out of control? Although fiat debasement and inflation are correlated, they truly are two different things that can coexist in juxtaposition for periods of time. The narrative that bitcoin is an inflation hedge has been widely talked about, but bitcoin has behaved more as a barometer of monetary policy than of inflation.

Macro analysts and economists are feverishly debating our current inflationary environment, trying to find comparisons and correlations to inflationary periods in history — such as the 1940s and the 1970s — in an effort to forecast where we go from here. While there are certainly similarities to inflationary periods of the past, there is no precedent for bitcoin’s performance under circumstances such as these. Bitcoin was born only 13 years ago from the ashes of the Global Financial Crisis, which itself unleashed one of the greatest monetary expansions in history up until that time. For the last 13 years, bitcoin has seen an environment of easy monetary policy. The Fed has been dovish, and anytime hawkishness raised its ugly head, the markets rolled over and the Fed pivoted quickly to reestablish calm markets. Note that during the same period, bitcoin rose from pennies to $69,000, making it perhaps the greatest-performing asset of all time. The thesis has been that bitcoin is an “up and to the right asset,” but that thesis has never been challenged by a significantly tightening monetary policy environment, which we find ourselves at the present moment.

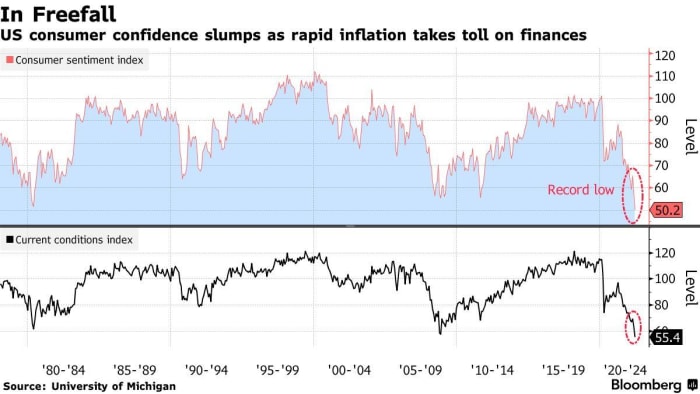

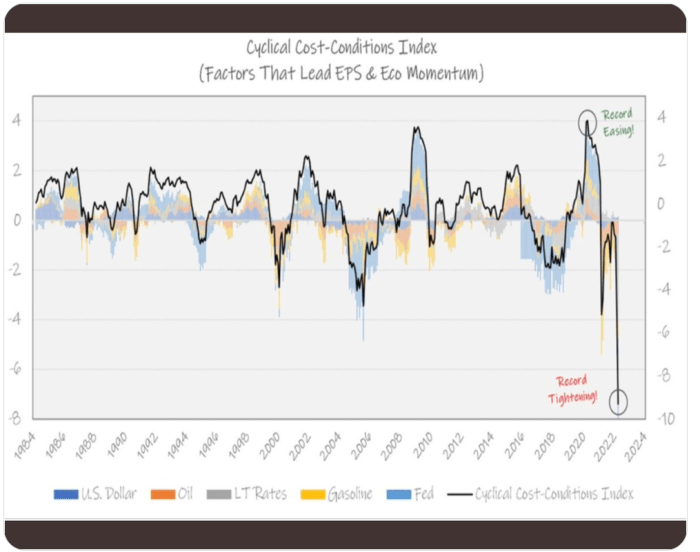

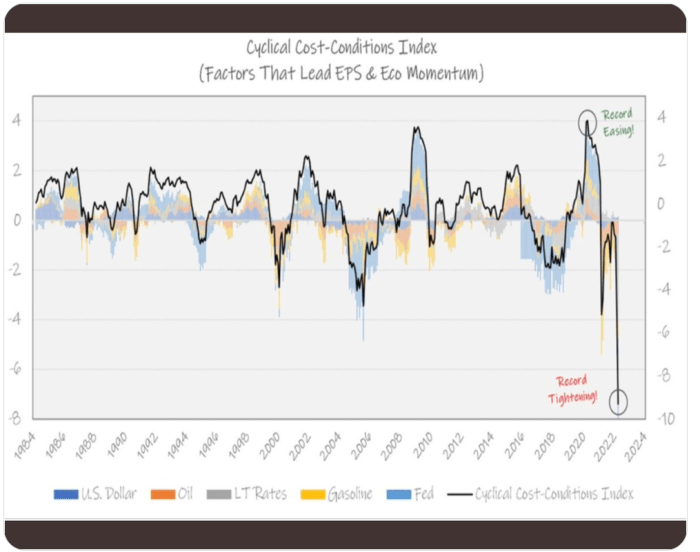

The old saying that “this time is different,” might actually prove to be true. The Fed can’t pivot to quell the markets this time. Inflation is wildly out of control and the Fed is starting from a near-zero rate environment. Here we are with 8.6% inflation and near-zero rates while staring recession straight in the eyes. The Fed is not hiking to cool the economy … It is hiking in the face of a cooling economy, with already one quarter of negative gross domestic product growth behind us in Q1, 2022. Quantitative tightening has only just begun. The Fed does not have the leeway to slow down or ease its tightening. It must, by mandate, continue to raise rates until inflation is under control. Meanwhile, the cost-conditions index already shows the biggest tightening in decades, with almost zero movement from the Fed. The mere hint of the Fed tightening spun the markets out of control.

(Source)

There is a big misconception in the market about the Fed and its commitment to raising rates. I often hear people say, “The Fed can’t raise rates because if they do, we won’t be able to afford our debt payments, so the Fed is bluffing and will pivot sooner than later.” That idea is just factually incorrect. The Fed has no limit as to the amount of money it can spend. Why? Because it can print money to make whatever debt payments are necessary to support the government from defaulting. It’s easy to make debt payments when you have a central bank to print your own currency, isn’t it?

I know what you’re thinking: “Wait a minute, you’re saying the Fed needs to kill inflation by raising rates. And if rates go up enough, the Fed can just print more money to pay for its higher interest payments, which is inflationary?”

Does your brain hurt yet?

This is the “debt spiral” and inflation conundrum that folks like Bitcoin legend Greg Foss talks about regularly.

Now let me be clear, the above discussion of that possible outcome is widely and vigorously debated. The Fed is an independent entity, and its mandate is not to print money to pay our debts. However, it is entirely possible that politicians make moves to change the Fed’s mandate given the potential for incredibly pernicious circumstances in the future. This complex topic and set of nuances deserves much more discussion and thought, but I’ll save that for another article in the near future.

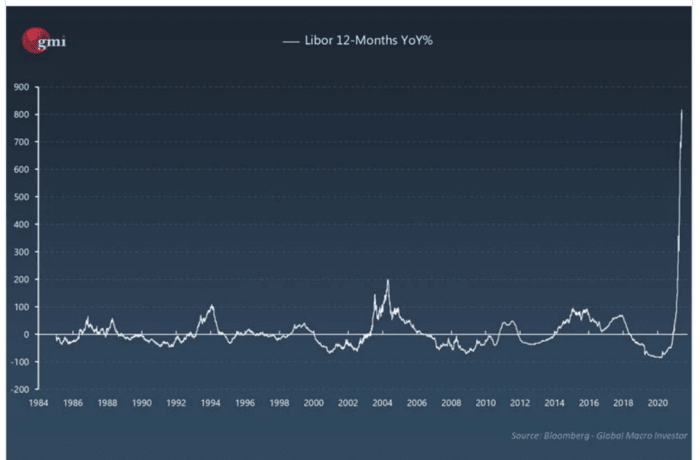

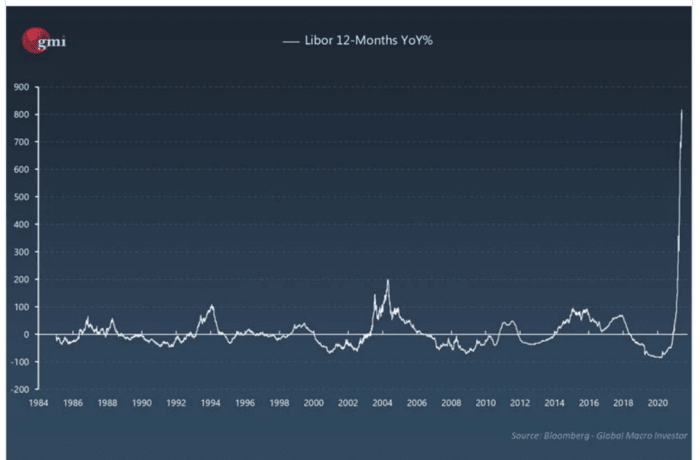

Interestingly, when the Fed announced its intent to hike rates to kill inflation, the market didn’t wait for the Fed to do it … The market actually went ahead and did the Fed’s job for it. In the last six months, interest rates have roughly doubled — the fastest rate of change ever in the history of interest rates. Libor has jumped even more.

(Source)

This record rate-increase has included mortgage rates, which have also doubled in the last six months, sending shivers through the housing market and crushing home affordability at a rate of change unlike anything we’ve ever seen before.

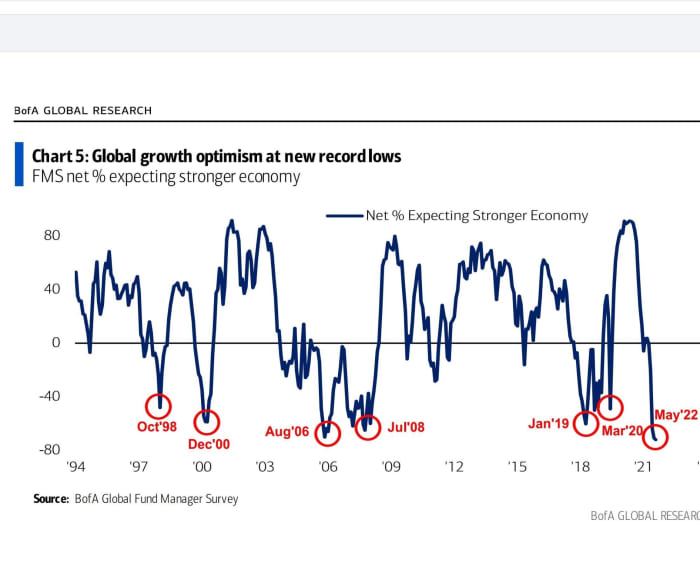

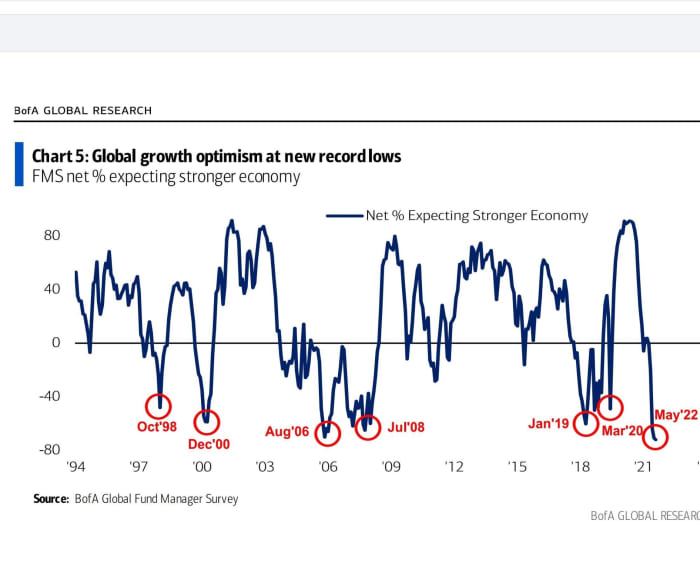

All of this, with only a tiny, minuscule, 50 bps hike by the Fed and the very beginning of their rate hike and balance sheet runoff program, merely started in May! As you can see, the Fed barely moved an inch, while the markets crossed a chasm on their own accord. The Fed’s rhetoric alone sent a chilling effect through the markets that few expected. Look at the global growth optimism at new all-time lows:

(Source)

Despite the current volatility in the markets, the current miscalculation by investors is that the Fed will take its foot off the brake once inflation is under control and slowing. But the Fed can only control the demand side of the inflationary equation, not the supply side of the equation, which is where most of the inflationary pressure is coming from. In essence, the Fed is trying to use a screwdriver to cut a board of lumber. Wrong tool for the job. The result may very well be a cooling economy with persistent core inflation, which is not going to be the “soft landing” that many hope for.

Is the Fed actually hoping for a hard landing? One thought that comes to mind is that we may actually need a hard landing in order to give the Fed a pathway to reduce interest rates again. This would provide the government the possibility of actually servicing its debt with future tax revenue, versus finding a path to print money to pay for our debt service at persistently higher rates.

Although there are macro similarities between the 1940s, 1970s and the present, I think it ultimately provides less insight into the future direction of asset prices than the monetary policy cycles do.

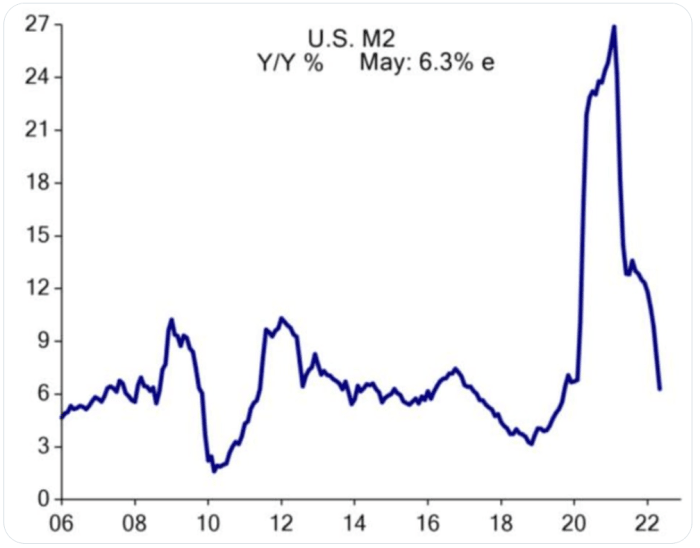

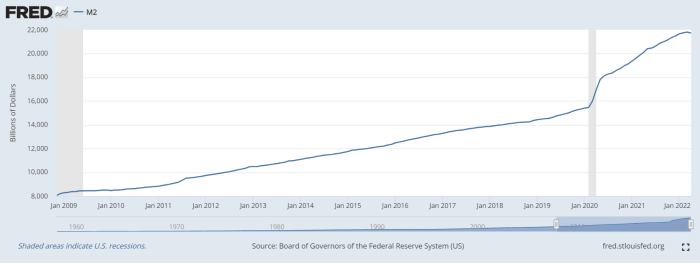

Below is a chart of the rate of change of U.S. M2 money supply. You can see that 2020-2021 saw a record rise from the COVID-19 stimulus, but look at late 2021-present and you see one of the fastest rate-of-change drops in M2 money supply in recent history.

(Source)

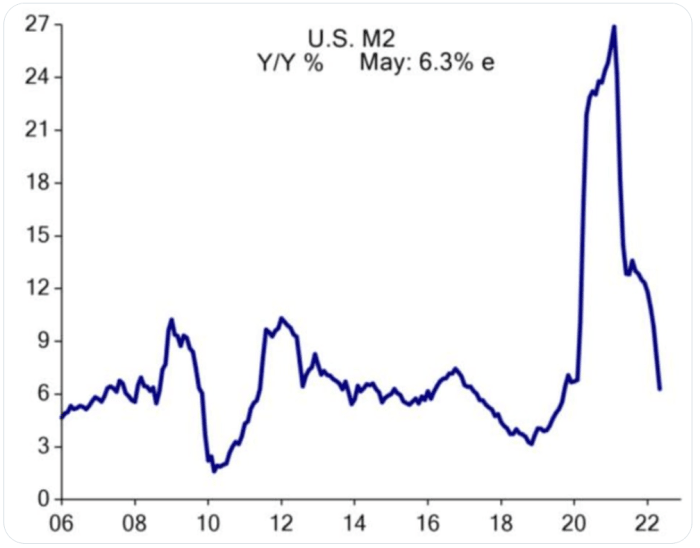

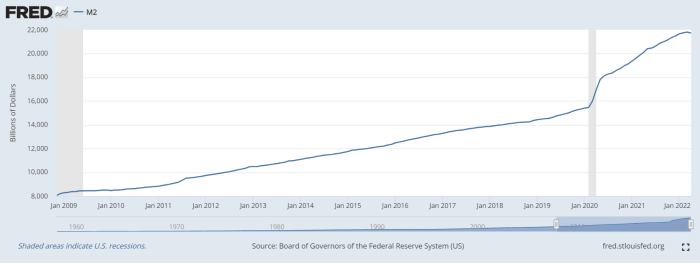

In theory, bitcoin is behaving exactly as it should in this environment. Record-easy monetary policy equals “number go up technology.” Record monetary tightening equals “number go down” price action. It is quite easy to ascertain that bitcoin’s price is tied less to inflation, and more to monetary policy and asset inflation/deflation (as opposed to core inflation). The chart below of the FRED M2 money supply resembles a less volatile bitcoin chart … “number go up” technology — up and to the right.

(Via St. Louis Fed)

Now, consider that for the first time since 2009 — actually the entire history of the FRED M2 chart — the M2 line is potentially making a significant direction turn to the downside (look closely). Bitcoin is only a 13-year-old experiment in correlation analysis that many are still theorizing upon, but if this correlation holds, then it stands to reason that bitcoin will be much more closely tied to monetary policy than it will inflation.

If the Fed finds itself needing to print significantly more money, it would potentially coincide with an uptick in M2. That event could reflect a “monetary policy change” significant enough to start a new bull market in bitcoin, regardless of whether or not the Fed starts easing rates.

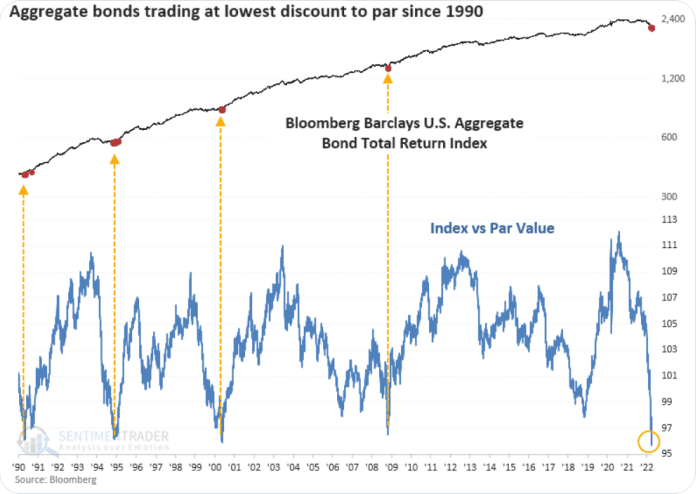

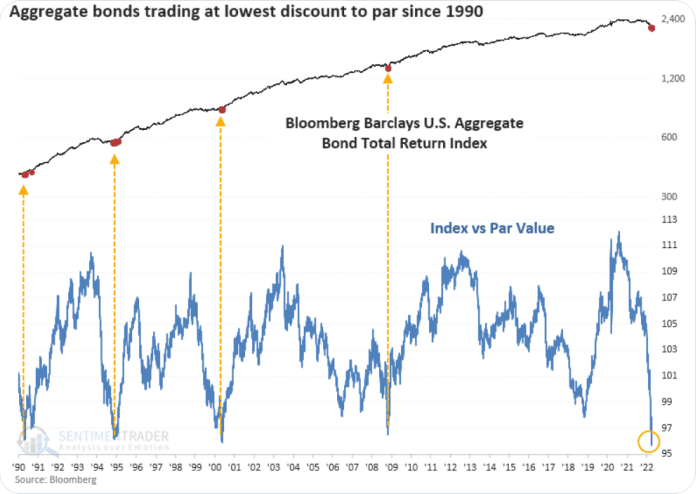

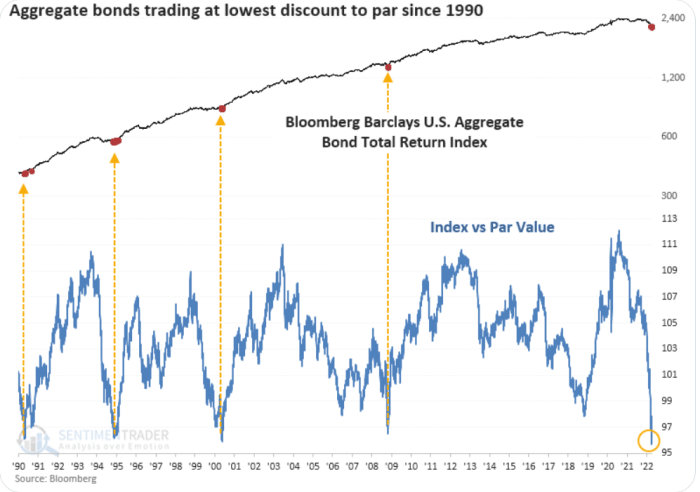

I often think to myself, “What is the catalyst for people to allocate a portion of their portfolio to bitcoin?” I believe we are beginning to see that catalyst unfold right in front of us. Below is a total-bond-return index chart that demonstrates the significant losses bond holders are taking on the chin right now.

(Source)

The “traditional 60/40” portfolio is getting destroyed on both sides simultaneously, for the first time in history. The traditional safe haven isn’t working this time around, which underscores the possibility that “this time is different.” Bonds may be a deadweight allocation for portfolios from now on — or worse.

It seems that most traditional portfolio strategies are broken or breaking. The only strategy that has worked consistently over the course of millennia is to build and secure wealth with the simple ownership of what is valuable. Work has always been valuable and that is why proof-of-work is tied to true forms of value. Bitcoin is the only thing that does this well in the digital world. Gold does it too, but compared to bitcoin, it cannot fulfill the needs of a modern, interconnected, global economy as well as its digital counterpart can. If bitcoin didn’t exist, then gold would be the only answer. Thankfully, bitcoin exists.

Regardless of whether inflation stays high or calms down to more normalized levels, the bottom line is clear: Bitcoin will likely start its next bull market when monetary policy changes, even if ever so slightly or indirectly.

This is a guest post by Jordan Wirsz. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Comments (No)