This past weekend saw the bear market in crypto and NFTs continue, to the dismay of holders around the globe. Prices are down, projects and companies fall by the wayside, and it’s crickets on NFT Twitter. Undoubtedly, many have already made their exit from the crypto space. Maybe for good.

However, for those who have stuck around, the bear market might be a time of opportunity. Let’s discuss just how that might be.

*This article is strictly for informational purposes and is not financial advice. Those seeking financial advice should consult with a licensed professional.

First things first – what is a bear market?

Like many in the crypto and NFT spaces, the phrase bear market is borrowed from traditional finance. It refers to a period during which the prices of securities sustain prolonged price decreases of 20% or more from recent highs.

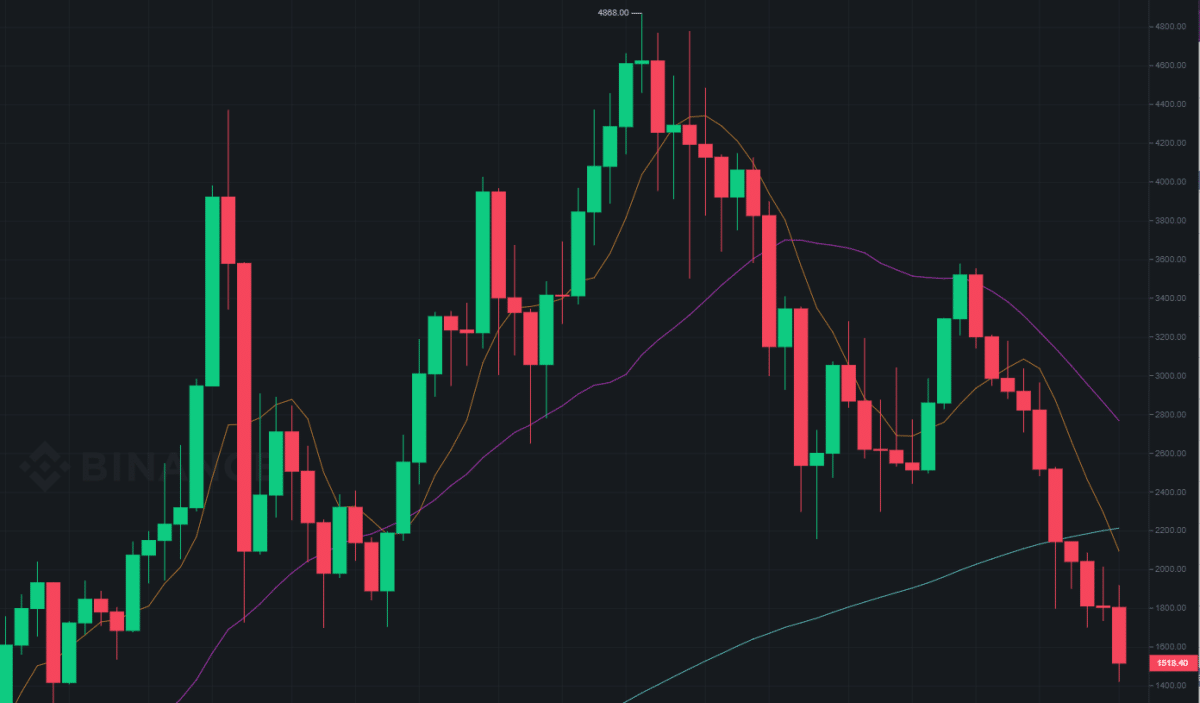

Today, the prices of the top two cryptocurrencies, Bitcoin and Ethereum, are down more than 70% from the all-time highs they hit in November 2021. Indeed, crypto markets have seen an overall downtrend for most of this year. Basically, all cryptocurrencies have fallen similarly, with some going all the way to zero. At the time of writing, 1 ETH is $1,169 – its lowest price since December 2020.

It’s a similar story in the NFT world. While the top NFT collections saw their floor prices hold strong or even increase earlier this year, even those collections have seen their floor prices fall dramatically over the past month or so. For example, take the marquee NFT collection. The Bored Ape Yacht Club has seen its floor price drop more than 10% in just the past 24 hours.

What caused the current bear market?

It’s important to realize that there are a great many factors in market sentiment at any given time. For one thing, the crypto market is still highly correlated to traditional markets at the present time. Further, traditional markets have also seen prices decline. So far this year, a number of major global events have lent themselves to an overall feeling of fear as it relates to the global economy.

There’s the continued economic fallout from COVID-19, supply chain disruption, the war in Ukraine, record levels of inflation, and expectations of an upcoming recession. These have all contributed to the current sentiment. Specifically in crypto, some high-profile thefts, the Terra/Luna fiasco, and the more recent fall of crypto lending platform Celsius have all led to disastrous outcomes for scores of cryptocurrency holders.

How to set yourself up during the bear market

If there are any positives to a bear market, it is what happens in the absence of quick money opportunities. The thought is that the people who remain are those who truly believe in blockchain tech. If you are confident and excited about the long-term future of blockchain technology, short-term changes are less impactful.

By the same token, many crypto enthusiasts argue that now might actually be a good time to secure assets you believe in. After all, the cost of entry into more established cryptocurrencies and popular NFT projects had been sky-high for many months.

For those who decide to invest in certain ecosystems over the bear market, one of the popularly discussed ways of doing this is a method called DCA (Dollar Cost Averaging). In essence, this means investing the same amount of money regularly over a period of time.

What’s good about DCA is that you can split up your buying over a longer time. This is as opposed to buying large amounts in one go. This both mitigates market fluctuations and allows you to spend a smaller amount of your monthly budget when buying crypto. While still stocking up on currencies you believe will increase in value over time.

Bear markets are also a good time to learn more about the space. It’s a cliché refrain in times like this, but the bear market really is for building. To illustrate, companies like OpenSea, Dapper Labs, POAP, and Larva Labs all built their foundations in the previous bear market. Thus, by staying engaged you can be an early adopter of a company, platform, or protocol that could shape the future of Web3.

Want some more advice? Take a cue from Zeneca

Popular NFT influencer and collector Zeneca laid out a very measured approach to the bear market in a June 12th blog post. To sum up, there’s a bottom line that Zeneca stresses in the article. In essence, those with conviction should do all that they can to stay in the space through the bear market.

For those who are overextended and facing crushing losses, this may be too much to ask. But for others in different situations who still have faith in the future of crypto, now is not the time to fold. On the contrary, Zeneca draws on his own experience of the last crypto bear market. Above all, he regrets losing interest in the space when the market crashed.

“What you decide to do is up to you, but I would highly encourage that you at least keep one eye on this wild and wacky world that is web3 so that you don’t come back in a few years and wish you never left.”

Are you tired of missing important NFT drops?

Check out our NFT Calendar!

Receive the biggest NFT news of the day & recommendations in our Daily newsletter.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

Comments (No)