While the crypto economy has dropped considerably in value during the last few weeks, seven-day statistics indicate non-fungible token (NFT) sales are down 17.32% lower than last week. Data also shows NFT floor values have tumbled a great deal during the past month as some of the most popular NFTs are selling for a lot less these days.

The Once Bubbly NFT Industry Faces Its First Crypto Bear Market, Non-Fungible Token Interest Is Down and Sales Slide

NFTs have made their mark over the last 12 months raking in billions of dollars in sales, but the NFT trend is currently experiencing its first crypto bear market. The market carnage during the past few weeks has taken a toll on NFT sales and the top floor prices stemming from some of the most popular collections.

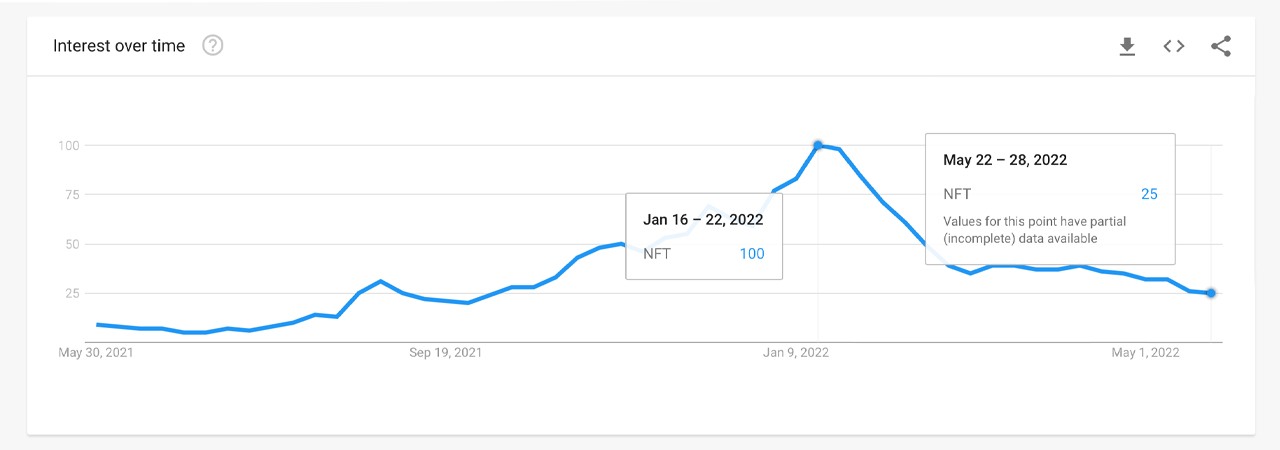

Interest in non-fungible tokens has waned as the search query “NFT” has dropped significantly according to Google Trends (GT) data. During the week of January 16-22, worldwide GT data for the search term “NFT” hit the top score of 100, but this week the search query term is 25.

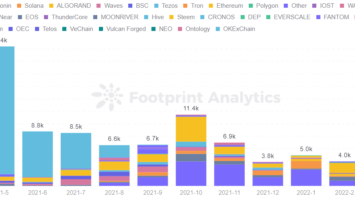

While NFTs are still selling, weekly sales are down 17.32% lower than the week prior and NFT sales measured last week were down 64% lower than the week before. It’s safe to say by looking at market metrics, that the Terra LUNA and UST fiasco impacted the NFT space as well.

Last week a great number of blue-chip NFT collections saw floor values drop and today the values are much lower. Moreover, a few popular NFT collections reached all-time highs in terms of floor values just 34 days ago, and current statistics show they now sell for a lot less.

Bored Apes, Proof Collective, and Cryptopunks Are Selling for Less Than Half of What They Sold for Last Month

On April 23, 2022, the NFT collection called Proof Collective had a floor value of around 129 ether and at that time, a single ethereum was exchanging hands for $2,950 per unit. This means that 34 days ago, the least expensive Proof Collective NFT was around $380K.

On that same day, Bored Ape Yacht Club’s (BAYC) floor value was approximately 123 ETH or $362K using ether exchange rates that day. The least expensive Cryptopunks NFT had a price tag of around 59 ether on April 23, which was around $174K back then.

Today, the Proof Collective NFT collection has a floor value of around 75 ether, and using ETH values recorded on May 27, the least expensive Proof Collective NFT today is selling for $130K. The floor value of the BAYC collection is $153K on Friday or 87.98 ETH and Cryptopunks’ NFT floor is 46.5 ETH or $80K.

34 days ago, Bored Ape Chemistry Club NFTs had a floor of around 45 ether and today, the lowest value is 39.5 ether. Similarly, Mutant Ape Yacht Club (MAYC) NFTs had a floor value of 33 ETH a month ago and today the lowest is 17.2 ether.

The Otherdeed NFT collection currently commands the top sales in terms of all the NFT collection sales this past week. Otherdeed sales amounted to $23 million during the last seven days but sales are down 14.52% lower than last week. One particular NFT collection called Goblintown, recorded $21.9 million in sales and jumped a whopping 1,744,444% higher than last week in terms of sales volume.

The top three most expensive NFTs sold this week stemmed from the Otherdeed NFT collection. Bored Ape #2664 was the fourth most expensive NFT sold at 199.99 ether ($390K) two days ago, and Cryptopunk #3764 was the fifth most expensive as it sold for 190 ether ($389K) four days ago.

In addition to the top three most expensive NFT collections in terms of floor value, non-fungible token collections like Clonex, Doodles, Azuki, Veefriends, Bored Ape Kennel Club, and more have all seen floor values drop much lower than the values recorded 34 days ago on April 23.

What do you think about the NFT sales dropping and blue-chip NFT collections seeing their floor values drop lower? How do you envision the NFT industry faring in a crypto bear market? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)