Blockchains have relied on proof-of-work (PoW) validation since their inception. Yet the PoW consensus proved to be unsustainable with its high energy usage and its need for fast, powerful hardware creating high barriers to entry. That’s why blockchains are adopting proof-of-stake consensus algorithms (PoS), where those wanting to earn rewards don’t have to compete against other miners, but can simply stake part of their crypto for a chance to be chosen to be a validator — and reap the returns.

Everyone who owns crypto on PoS blockchains must want to take advantage of the opportunities staking provides, right? Actually, according to our report, while 56% of those surveyed had staked before, many who hadn’t staked or wouldn’t stake again pointed toward the same hesitation: They don’t want their assets locked up in staking, not when those assets could be put to use elsewhere. This is why liquid staking provides the best of both worlds. It allows investors to stake their assets while also allowing them to use those assets in other projects during lock-up.

Despite the fact that this innovation is able to lower barriers to staking, there’s still confusion about what liquid staking is and what it can offer to the crypto community. What follows are some of the misconceptions about liquid staking and what the truth is about this new opportunity.

Related: The many layers of crypto staking in the DeFi ecosystem

What is liquid staking?

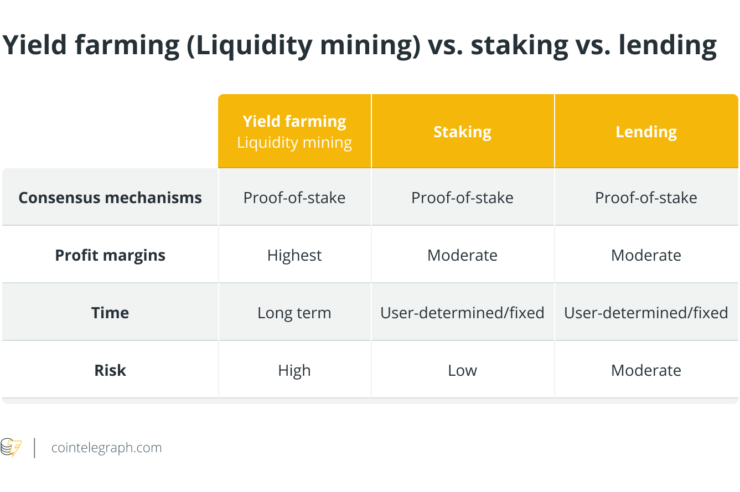

Staking is changing the way blockchains function. It brings better energy efficiency to blockchain validation, more flexibility to the hardware needed and quicker transaction frequency. But despite its benefits, one of its biggest challenges — and what’s holding many back from staking — is the lock-up period. Assets are inaccessible to the holder while being staked, and those owners can’t do anything with them — like invest in decentralized finance (DeFi) — while they’re being staked. It’s because of this sacrifice that many are hesitant to stake.

However, liquid staking solves this issue. Liquid staking protocols allow holders of staked assets to get liquidity in the form of a derivative token that they can then use in DeFi — all while the staked assets continue to earn rewards. It’s a way to maximize earning potential while having the best of both worlds.

PoS is also swiftly rising in popularity. PoS protocols account for over half of crypto’s total market cap, a total of $594 billion. The opportunities will only increase as Ethereum moves fully to PoS in the coming months. However, only 24% of the total market capitalization of staking platforms is locked in staking — meaning there are many who can stake but aren’t doing so.

Related: The pros and cons of staking cryptocurrency

Four misconceptions of liquid staking

Despite the benefits of liquid staking, there’s still confusion about how it functions. Here are four common misconceptions, and how you should be thinking about liquid staking instead.

Misconception 1: Only one player or protocol will exist. One of the misconceptions about liquid staking is that only one player will exist through which investors can gain liquidity. It may seem that way since it’s still so early in the liquid staking space, but in the future, multiple liquid staking protocols will coexist. There may also be no capping to the number of liquid staking protocols that can coexist, either. In fact, the more the number of protocols, the better it is for the network, as it can reduce instances of stake centralization and fears of a single point of failure.

Misconception 2: It’s only limited to liquidity. Liquid staking isn’t just a way to get liquidity. While liquid staking does help PoS networks acquire staked capital that secures the network, it is not just limited to that. It’s also a way to get composability because you can use your derivative in multiple places, which you can’t do with an exchange. The synthetic derivatives that are issued as part of liquid staking and used in supported DeFi protocols for generating more yield actually help in constructing monetary building blocks across the ecosystem.

Misconception 3: Liquid staking is solved at the protocol level. People think liquid staking will be solved at the protocol level itself. But liquid staking isn’t just about enabling functionality at a protocol level. It’s about coordinating with other protocols, bringing more use cases, more features and more usability. A liquid staking protocol is solely focused on developing the architecture that will facilitate the creation of synthetic derivatives and ensuring that there are DeFi protocols with which those derivatives can be integrated.

Misconception 4: Liquid staking defeats the purpose of staking overall. Some say liquid staking defeats the purpose of staking or locking up assets, but we’ve seen that’s not true. Liquid staking not only increases network security but also helps achieve a crucial objective of the PoS network, which is staking. If there is a solution that issues derivatives for staked capital within the network, then not only is the staked capital ensuring that the PoS network is secure, but it is also creating an enhanced experience for the user by enabling capital efficiency.

The future of PoS

Liquid staking not only solves a problem for crypto enthusiasts who want to stake by issuing tokens they can use in DeFi while their assets are staked. An increase in those staking their assets — which is made easier by making liquid staking available — actually makes the blockchain more secure. By learning the truth about common misconceptions, investors will enable staking to truly become an innovative new way for blockchains to achieve consensus.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Mohak Agarwal is the CEO of ClayStack. He is a serial entrepreneur and investor on a mission to unlock the liquidity of staked assets.

Comments (No)