Tether CTO, Paolo Ardoino, told us last month that Tether was prepared for a bank run. Ardoino and the Tether team have run models to simulate a 2008-style financial crisis and believe that it will continue to be able to honor all redemptions even if a similar situation occurs.

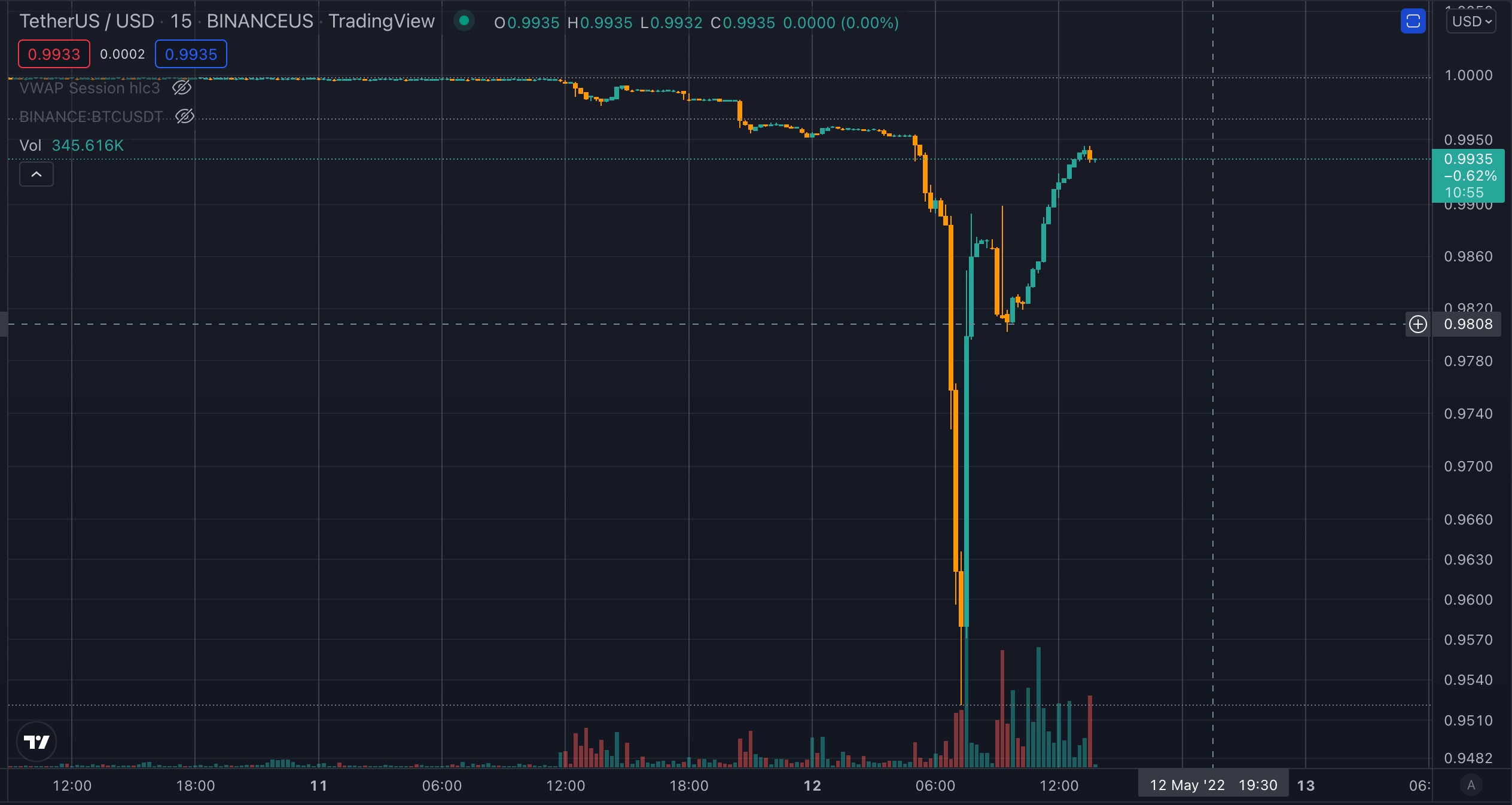

Tether’s peg to the US Dollar was rocked yesterday as it fell to $0.95 on major exchanges such as Binance.US and Coinbase. The token traded below $0.995 for the longest time since March 2020 closing several four-hour candles below the 0.005 level. Currently, it has recovered to$0.993 and it looks like the peg may soon be restored. If the peg does come back then Tether may view a 5% max pain drop and a 48-hour recovery as a successful stress test. However, the potential for this level of volatility could now be priced into the crypto market as a whole. When stablecoins have the potential to swing 5% confidence will undoubtedly be hit.

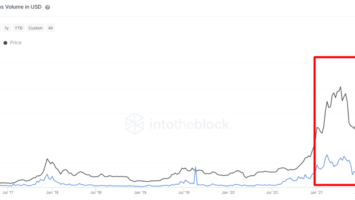

Regarding the current market conditions, Ardoino tweeted, “Reminder that tether is honoring USDt redemptions at 1$.” In our interview, Ardoino claimed that Tether has never refused redemption. However, it appears that investors need at least $100,000 Tether to use their redemption service and must be outside of the US unless they qualify as an Eligible Contract Participant. Tether declared they have serviced over $300 million in Tether redemptions in the past 24 hours.

When asked whether Tether will always remain pegged to the dollar, Ardoino commented:

“We take into account the worst moments in the history of finance… when we have to simulate what a bank run situation would look like on a Tether portfolio.”

Further in the conversation, he states that if we experience hyperinflation and a “pizza costs $1 million,” it would also be “1 million USDT.” The conversation was focused on the rising global inflation and the hypothetical demise of fiat currency. However, today, it is stablecoins that are in the news cycle with a fear that they may be wiped out amid the volatile market conditions.

Watch the full interview here for more insight into how Tether prepared for a bank run (apologies for the audio quality due to a technical issue):

In response to a direct request for comments, Tether issued the following statement regarding the current market conditions;

Tether is pleased to report that it is business as usual amid some expected market panic following this week’s market movements.

Tether continues to honour redemptions normally, with verified customers (in allowed jurisdictions) able to redeem USDt on Tether.to for USD$1. In the last 24 hours alone, Tether has honoured over 300m USDt redemptions and is already processing more than 2bn today, without issue.

Tether has maintained its stability through multiple black swan events and highly volatile market conditions and even in its darkest days Tether has never once failed to honour a redemption request from any of its verified customers. Tether will continue to do so which has always been its practice.

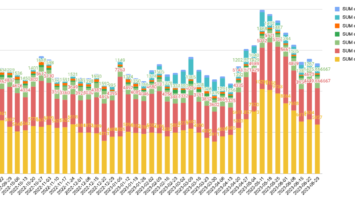

Tether is the most liquid stablecoin in the market, backed by a strong, conservative portfolio that consists of cash & cash equivalents, such as short-term treasury bills, money market funds, and commercial paper holdings from A-2 and above rated issuers. The value of Tether’s reserves is published daily and updated once per day. You can find the most recent information here: https://tether.to/en/transparency.

Comments (No)