Serial entrepreneur and former Moonbirds COO Ryan Carson revealed that his 1.21 Gigawatts Fund (121G) has just received $40 million in investment commitments. Carson launched the website on April 25 shortly after he announced his departure from Moonbirds.

There were 99 available investment spots in total, and each investor had to commit to 100 ETH to participate. On Tuesday 3rd May, Carson tweeted that the fund has over 14,000 ETH in commitments. Furthermore, he announced that capital will start deploying in July.

What is Ryan Carson’s 1.21 Gigawatts Fund (121G)?

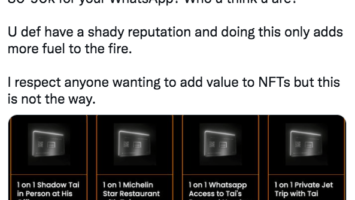

Ryan Carson set up the 121G fund to “perfectly capture this historic opportunity by utilizing these strategies to maximize returns for our investors.” The fund will commission one-of-ones by the world’s top NFT artist; secure allowlist access for its members for highly-anticipated future projects; and network to secure hard-to-acquire blue-chip NFTs. Additionally, it will be used to buy a strategic ratio of floor-to-rare pieces; as well as use cutting-edge information to shape the fund’s acquire and hold strategy.

The Ryan Carson fund stands out from the crowd because it has a long-term view of the NFT market. It is essentially an investment fund that charges members a 20% profit and a 2% management fee. According to the website, the 121G fund will acquire popular NFTs before traditional institutions enter the NFT market.

On April 25th, Ryan Carson also announced his departure from the Moonbirds NFT collection, barely a week after the collection sold out. Immediately after, Carson announced the 121G fund.

Are you tired of missing important NFT drops?

Just check out our NFT Calendar!

Receive the biggest NFT news of the day & recommendations in our Daily newsletter.

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

Comments (No)