Citing compliance with local jurisdictions, crypto exchange Coinbase announced to soon collect additional information from users based in Canada, Singapore and Japan.

Effective from April 1, Coinbase users from Canada, Singapore and Japan will be required to provide additional information while sending cryptocurrencies to a different (non-Coinbase) platform.

However, while Singaporean and Japanese investors will be required to share additional information about the recipient for every single off-platform transaction, Canadians sending less than $801 (1,000 CAD) will be exempted from this requirement.

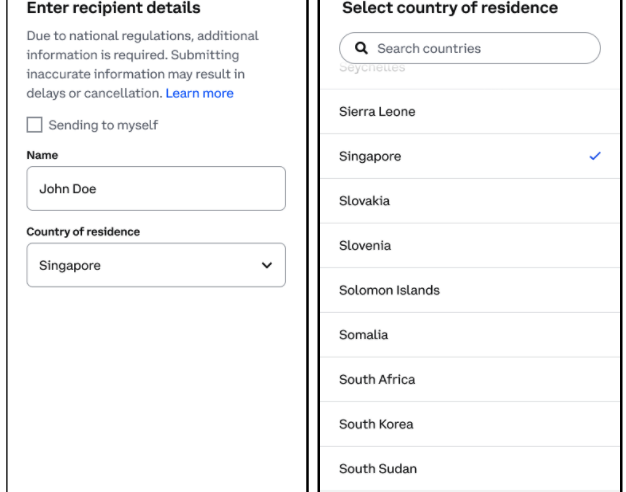

As shown in the above screenshot, Canadian users will need to share the full name and residential address of the recipient.

Moreover, Canadian users — that suffice the above two conditions — will lawfully require to provide the recipient’s (self) information even while transferring funds between their own crypto wallets.

On the other hand, both Japanese and Singaporean regulations will require Coinbase to collect information about the recipients from local investors for every single off-platform transaction with no minimum threshold.

Similar to Canadian users, investors from Japan will need to disclose information including the recipient’s name and full address and the name of the crypto exchange handling the wallet.

Singapore users will not require to provide the recipient’s residential address but will require only the recipient’s name and country of residence. The lack of any required information will bar the user from sending cryptocurrencies out of the Coinbase platform for the jurisdictions in question.

Coinbase users that no longer reside in these jurisdictions will need to update their country of registration in order to gain exemption from the soon-to-be-implemented rule.

Related: Thailand SEC bans crypto payments, seeks disclosure of system failure from exchanges

For many jurisdictions, the road to mainstream crypto adoption is paved by stringent regulations under the pretext of investor protection. Starting April 2022, the Thailand Securities and Exchange Commission (SEC) announced a ban on crypto payments throughout the country.

Complementing this law, the SEC also proposed a new rule, which if implemented, will require Thai-based crypto businesses — brokers, exchanges and dealers — to disclose service quality and IT usage information.

As Cointelegraph reported, a joint study between the Thai SEC and Bank of Thailand (BOT) concluded that:

“[Crypto payments] may affect the stability of the financial system and overall economic system including risks to people and businesses.”

Comments (No)