A paradox of cryptocurrency is that while early adoption was fuelled by anti-government and cypherpunk ideals, buying and holding crypto can actually be more traceably than traditional currencies because of the open nature of the blockchain ledger.

On the other hand, those who make efforts to mask their identity can indeed buy crypto anonymously. This article will explain the most effective ways to buy crypto anonymously, from the point of sale to masking transactions.

Step 1: Buy Crypto Without KYC

Find a P2P Trading Platform with No KYC

Almost all centralized exchanges require personal identification to buy and sell crypto. To buy crypto anonymously, you will have to use a peer-to-peer platform.

With rules and regulations always changing, some of the platforms listed below may eventually require verification despite having anonymity as a goal.

Several previously non-KYC platforms, like Binance, for example, eventually shifted to require identification. Currently, only decentralized P2P platforms, which serve to connect users to one another, let users buy crypto anonymously.

Paxful

On Paxful, US users must submit ID after creating an account. However, as of the time of this article, users outside of the US can buy and transfer up to $1,000 without ID. However, there is nothing to stop a user from setting up multiple accounts and wallets to bypass this requirement for now. Users have the option of purchasing with Amazon Gift Cards.

LocalCryptos

Localcryptos.com was previously called Local Ethereum but changed its name as it expanded to support more tokens. It has no ID requirements or purchase limits. According to the website, all messages between users are end-to-end encrypted. Some common methods of payment on LocalCryptos are Paypal, Western Union, and cash deposit — which can tie users back to their crypto purchases.

Bisq

Bisq is an exchange set up for the purpose of being secure, private, and censorship-resistant. There are dozens of ways to make fiat payments, including money order and Amazon eGift Card, the latter of which is a relatively simple and private way to buy crypto anonymously.

Step 2: Mix Your Crypto (if Bitcoin)

One way to increase the security of the funds you bought from a P2P exchange is through a process called “mixing.” This technique involves breaking up a transaction into many smaller transactions that are then sent to different addresses. The idea is that it becomes very difficult to track the original source of the funds.

A number of online services offer this type of service. The most notable is Blender. It requires you to deposit your coins into their wallets, after which they will mix them with other users’ funds and then send them back to you. The process usually takes a few hours.

To increase your opsec even further, you can send the funds to multiple addresses, but this will increase the fees. Additionally, time delays allow you manually set when the coins will arrive in the receiving address, making it difficult for anyone to trace your coins to a particular timeline.

Here are some popular bitcoin mixers.

- Blender

- Chipmixer

- Wasabi Wallet

Step 3: Use DEXs instead of centralized exchanges

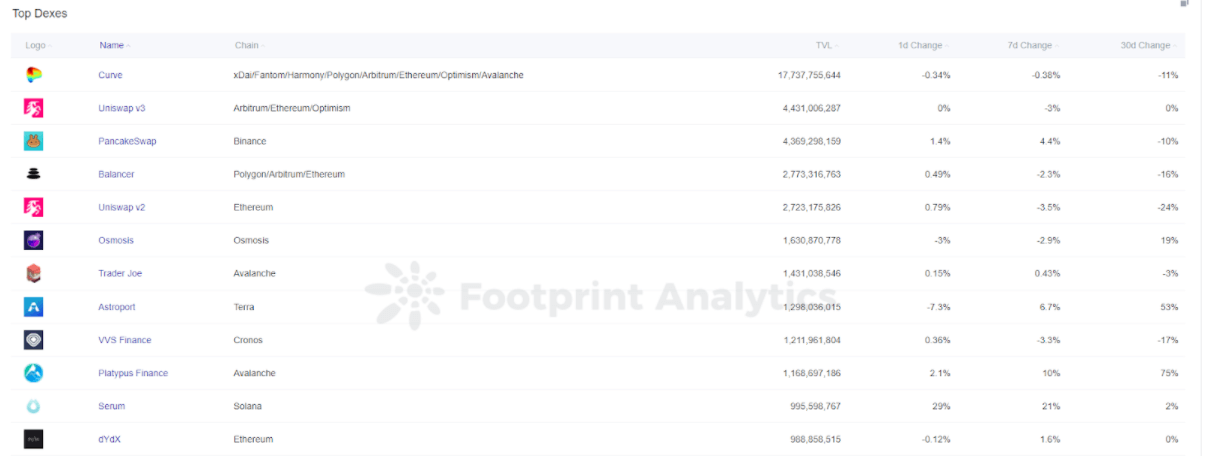

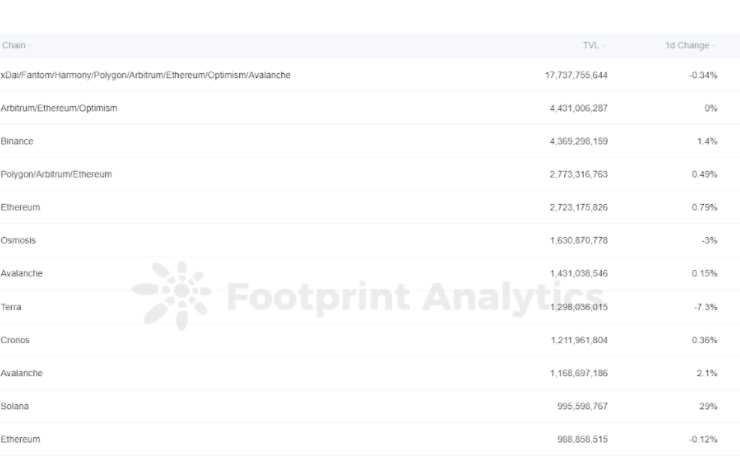

Whereas centralized exchanges like Binance, Kraken, and Crypto.com require KYC for many types of transactions, decentralized exchanges do not (instead, requiring only a wallet address.) For this reason, those who are concerned with privacy should become familiar with the top DEXs and how to use them.

There are nearly 400 DEX protocols and most work quite similarly. However, there are some differences in their tokenomics. As of March 13, the top 5 DEXs by TVL are Curve, Uniswap, PancakeSwap, Balancer, and Osmosis.

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Get your daily recap of Bitcoin, DeFi, NFT and Web3 news from CryptoSlate

Get an Edge on the Crypto Market 👇

Become a member of CryptoSlate Edge and access our exclusive Discord community, more exclusive content and analysis.

On-chain analysis

Price snapshots

More context

Comments (No)