In a report published on Saturday, the International Monetary Fund (IMF) has warned that an ongoing war in Europe and associated sanctions will have a “severe impact on the global economy.” The IMF’s report says there is “extraordinary uncertainty” in the air, and the international financial institution believes “economic consequences are already very serious.”

IMF’s Economic Outlook Amid Ongoing War in Europe Predicts Inflationary Pressures, Supply Chain Disruptions, and Price Shocks

With a crisis happening in the world, many analysts and economists are concerned about the global economy and the aftermath of the warfare taking place in Ukraine. Additionally, Russian sanctions are being discussed or implemented daily by a large quantity of countries across the globe.

On Saturday, the IMF issued a staff statement concerning the economic impact of the war in Ukraine after the executive board met on March 4. The report notes that the meeting was chaired by the IMF’s managing director Kristalina Georgieva. The IMF’s outlook is not great and the international financial institution has noticed the energy and commodities boom last week.

All of this has added to “inflationary pressures from supply chain disruptions” and it could slow the Covid‑19 pandemic rebound, the IMF’s report details. “Price shocks will have an impact worldwide, especially on poor households for whom food and fuel are a higher proportion of expenses,” the IMF’s statement adds.

The IMF’s report explains war-related issues could further cause economic fallout across a myriad of countries. “Should the conflict escalate, the economic damage would be all the more devastating — The sanctions on Russia will also have a substantial impact on the global economy and financial markets, with significant spillovers to other countries,” the IMF communications department statement notes.

Gold Continues to Rise, US Futures Markets Slide, Crypto Economy Slips More Than 3% in 24 Hours

The statements from the IMF published on Saturday follow the recent signals of a pending recession, and one analyst who noted the economic fallout could be “10x worse than the Great Depression.” Inflation has been on the rise, and investors are worried about hawkish central banks raising interest rates and tapering large asset purchases. More specifically, the U.S. Federal Reserve is expected to raise the benchmark interest rate, but people some predict the ongoing conflict in Europe could stop this from happening.

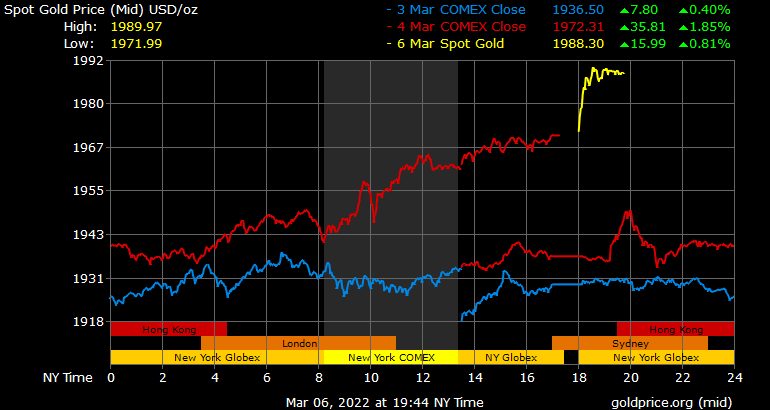

Meanwhile, the price of a single ounce of .999 fine gold has risen 0.84% during the last 24 hours, reaching a high of $1,989 per ounce on March 6. On Sunday evening (EST) Dow Jones futures dropped significantly, alongside declines stemming from Nasdaq futures and S&P 500 futures. Equities markets are expected to get roiled on Monday and the global cryptocurrency market capitalization on Sunday slid in value. At 8:00 p.m. (EST) on Sunday the crypto economy is down $1.8 trillion, recording a -3.2% change during the last 24 hours.

The IMF noted that there has been critical infrastructure damage in Ukraine. Last week, the IMF explained that the country has $2.2 billion available between now and the end of June. Moreover, World Bank Group, the group of five international entities that makes leveraged loans to countries, is “preparing a $3 billion package of support in the coming months,” the IMF detailed on March 1.

What do you think about the IMF’s report concerning the global economy amid an ongoing war? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)