Despite China’s blanket ban on all crypto-related activities in the country, residents of the country still account for roughly 10% of all global transactions involving digital assets.

This was revealed by the People Bank of China in a report where it examined how the crypto crackdown has affected financial markets in the country.

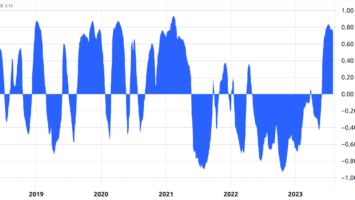

China’s crypto activities drop by 80%

According to the report, all P2P online lending platforms no longer operate within the country, and the outstanding loan balance has now dropped to 490 billion yuan from 1.2 trillion yuan.

The report also stated that the bank plans to “integrate all the financial business of Internet platform enterprises into supervision (and) standardize business cooperation between licensed institutions and Internet platform companies.”

Notably, the Chinese government has dealt with the industry from as far back as 2013. The country first banned financial institutions like banks from facilitating Bitcoin transactions and started investigating several crypto firms in 2017.

Its investigation into these firms forced many of them to shut down, however, the industry, somehow, remained buoyant in the country as miners from the country dominated the global hash rate.

But in 2021, the government enforced a total crackdown on the crypto space, banning all crypto mining and trading activities within its jurisdiction.

Jail time for crypto-traders

Since then, all its efforts have been geared towards eradicating crypto transactions in the country. The Chinese Supreme Court recently stipulated that crypto trading is illegal fundraising. This ruling finally gives interpretation to the law banning crypto.

With that, activities such as OTC, ICO/IDO, crypto exchange, crypto futures, and yield farming are all illegal fundraising activities. Individuals found liable for any illegal fundraising from 5000 people, above 50 million yuan ($7,913,645), or causing donors to lose 25 million yuan can lead to imprisonment of over ten years.

Given that the interpretation is already in effect, trading crypto in the country now puts individuals at risk of long jail terms.

Even with the 80% drop in trading volume, authorities remain committed to eradicating crypto and curbing the hype that surrounds it.

According to the report, it “severely cracked down on illegal financial activities such as disorderly handling of finance and fundraising without a license and launched a special campaign against illegal fund-raising crimes.”

However, it should be noted that despite the Chinese government’s best effort to eradicate crypto in their country, its citizens have devised new means of crypto trading and some miners have also been able to stay under the radar.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)