Grayscale parent Digital Currency Group, better known as DCG, announced that it intends to repurchase up to $250 million in shares for various Grayscale investment products.

The share repurchase program is centered around Grayscale’s Litecoin Trust, Horizon Trust, Zcash Trust and other Grayscale products, DCG confirmed on Wednesday. The pace and timing of the share repurchase are not fixed and will depend on several factors, “including the levels of cash available, price, and prevailing market conditions,” the company said.

Digital Currency Group Announces $250 Million Share Repurchase Program for Grayscale® Litecoin Trust (OTCQX: $LTCN), Grayscale® Horizen Trust (OTCQX: $HZEN), Grayscale® Zcash Trust (OTCQX: $ZCSH), and other Grayscale Products https://t.co/zKoEWkfyk1

— Barry Silbert (@BarrySilbert) March 2, 2022

As Cointelegraph reported, DCG first announced plans to purchase shares of its Grayscale products in March 2021, allocating up to $250 million towards the flagship GBTC Bitcoin (BTC) product.

Like its previous share repurchase announcement, DCG’s Wednesday statement didn’t specify the reasoning behind its latest buyback.

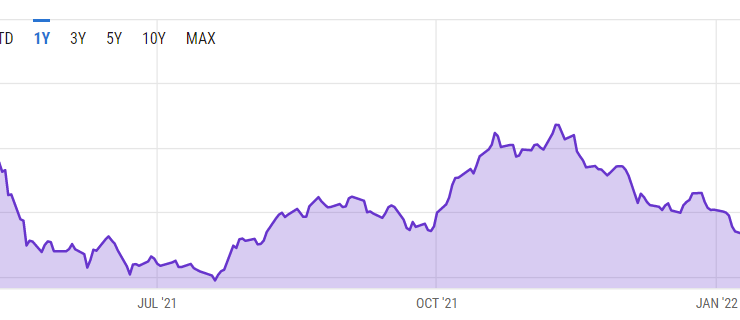

Grayscale is the world’s largest crypto asset manager with nearly $27 billion in assets under management, according to the latest data. The value of Grayscale’s holdings has declined from a peak of around $43.6 billion in November, reflecting a sharp pullback in the price of Bitcoin and the broader cryptocurrency market.

Related: SEC again delays decision on Grayscale’s Bitcoin ETF

Institutional investors have increased their exposure to cryptocurrency products over the past year, though their interest has waned during periods of extreme market volatility. After a prolonged drawdown, crypto investment funds appear to be attracting new capital in recent weeks. Inflows into crypto funds totaled $36 million last week, with Bitcoin products registering five consecutive weekly inflows totaling $239 million, according to CoinShares data.

Comments (No)