Osmosis Labs, one of the developers of the first DEX servicing projects connected through the Interblockchain Communication Protocol (IBC) recently announced the launch of Superfluid Staking on Osmosis.

The new feature on the interchain DEX unlocks the opportunity to earn dual incomes by allowing staked assets that support the security and stability of blockchains to be actively used as liquidity.

Introducing the ‘Proof of Useful Stake’

LPs who bond/lock their assets in an Osmosis liquidity pool can accrue fees and liquidity mining incentives for facilitating trading in the pool. But now, thanks to the new feature, the story doesn’t end there–LPs can choose to stake their bonded LP shares with a validator and earn a portion of the Osmosis staking APR on top of the APR they would accrue by simply bonding their LP shares in a liquidity pool.

Unlike the case with regular liquid staking, Osmosis’ new feature doesn’t involve creating synthetic representations of staked assets but implies staking tokens that are already being used in DeFi.

“This innovation is an exciting step not just for the interchain ecosystem, but also the evolution of PoS, effectively creating the first-ever ‘Proof of Useful Stake,’” explained Sunny Aggarwal, Co-Founder of Osmosis Labs.

On Osmosis, users no longer have to opt between backing PoS blockchains and providing liquidity on the DEX–with Superfluid Staking they can do both at the same time.

“The launch of Superfluid Staking on Osmosis is the culmination of a simple, but powerful insight–when you provide liquidity you lock up your tokens, which is also what you do when you stake. So if they’re locked and have OSMO underlying them, why can’t we actually use them in Proof of Stake? This would help provide stability and security to the chain, and Superfluid Staking is simply the mechanism by which you can earn additional rewards for providing that service,” Aggarwal explained.

What does it mean for the Cosmos ecosystem?

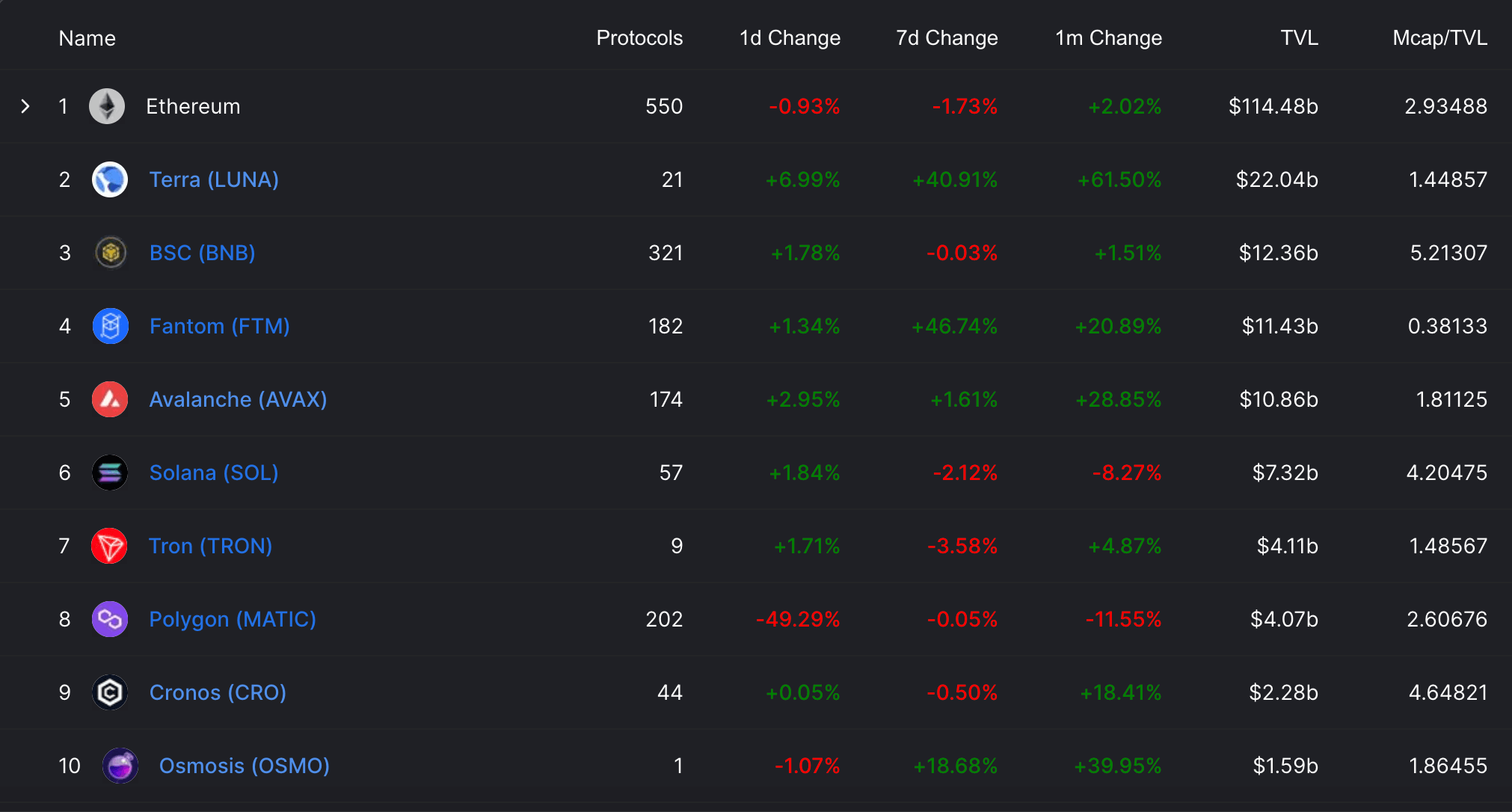

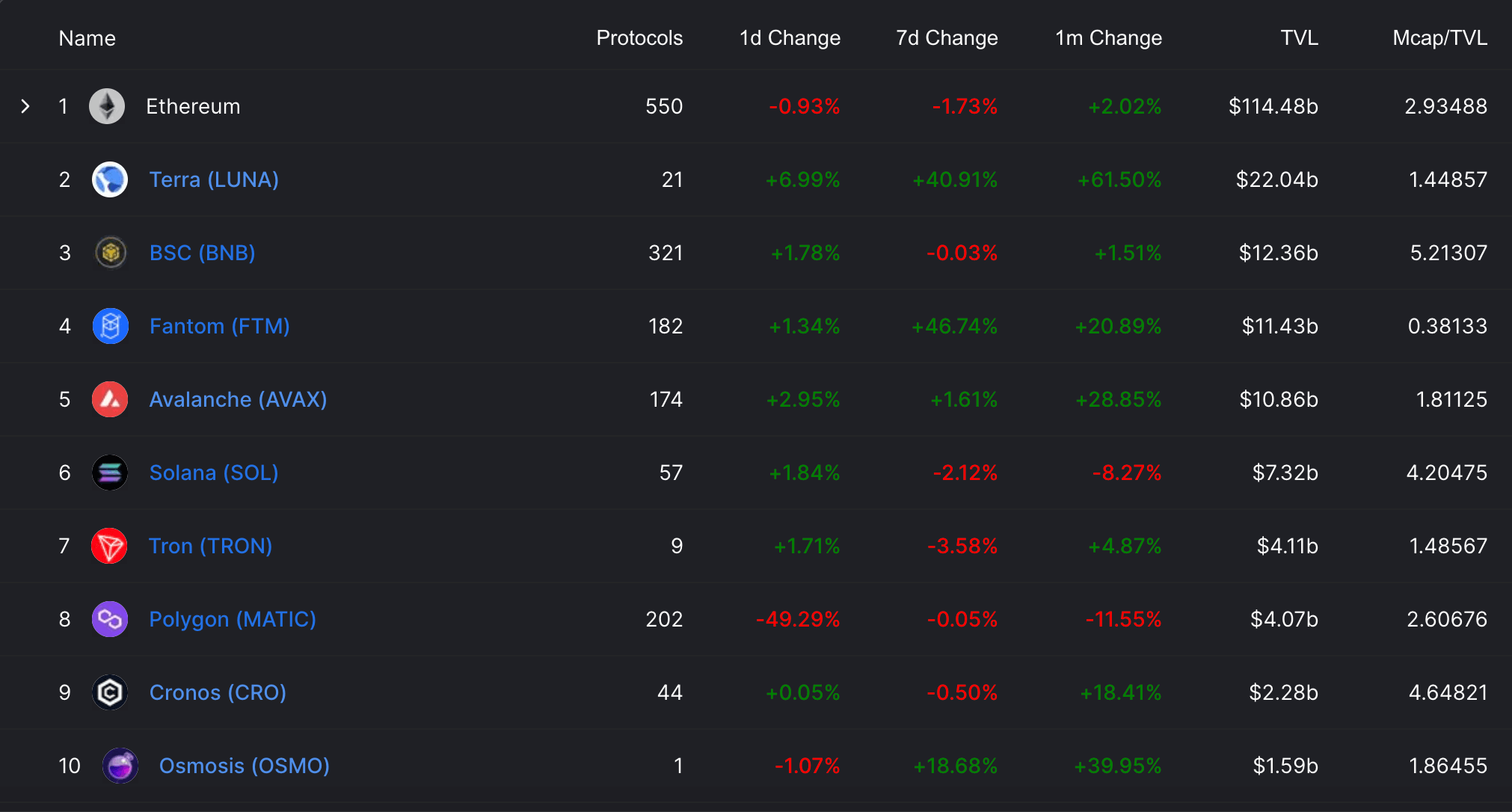

Home to only one protocol, the Osmosis zone is currently the 10th chain by TVL, according to the data provided by DeFi Llama.

In the Cosmos interchain ecosystem, decentralized apps launch their own blockchains, also called “zones”– with each having its own staking token and an independent set of validators.

However, within the multi-chain architecture, smaller Cosmos zones are less secure than larger ones–discouraging investors from investing their funds which would enable those chains to grow stronger.

This is where Superfluid Staking which unlocks two different APRs for LPs comes in–enabling smaller zones to attract investors with high yields, without compromising on security.

The new feature will incentivize the increased health of the $70 billion Cosmos ecosystem by securing smaller zones whose tokens are listed on Osmosis, while providing those chains with liquidity.

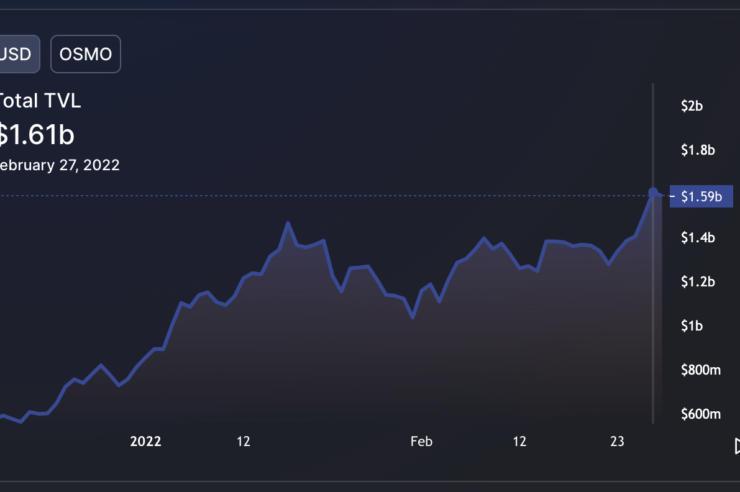

Osmosis has been rapidly growing since it launched in June 2021.

The interchain DEX broke $100 million in daily trade volume in January 2022 and recently saw its liquidity ATH–reaching $1.61 billion in total value locked (TVL) on February 27.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)