It is not the first time the U.S. Securities and Exchange Commission (SEC) rejected proposals for a Bitcoin spot exchange traded product (ETP), but efforts continue to be made by different financial institutions. The recent attempt made by Cboe BZX Exchange on Jan. 25 to list the Fidelity Wise Origin Bitcoin Trust as a Bitcoin ETP has also failed.

The SEC letter published on Feb. 8 pointed out that the exchange has not met its burden to demonstrate the fund is “designed to prevent fraudulent and manipulative acts” and “to protect investors and the public interest”.

Although proposals of Bitcoin spot ETPs have never been approved by the SEC and such products are not available in the U.S. market, they do exist in the European market. By investigating the prices of these ETPs traded in the European market, one could have a good insight into whether fraudulent and manipulative acts are possible.

To investigate whether the SEC’s concerns of fraudulent and manipulative acts are justifiable, this article will compare the historic prices of three European listed ETPs and the Bitcoin spot price history from 18 exchanges to see if there are any significant price disparities that could induce market manipulation.

The SEC’s primary concerns

There were two major concerns raised by the SEC from a technical perspective towards BZX Exchange’s proposal:

(1) No data or analysis was provided to support the argument that arbitrage across the Bitcoin platforms helps to keep global Bitcoin prices aligned with one another, thus hindering manipulation and eliminating any cross-market pricing differences. There is no indication of how closely Bitcoin prices are aligned across different Bitcoin trading venues or how quickly price disparities may be arbitraged away.

(2) The Exchange does not demonstrate the proposed methodology for calculating the index would make the proposed ETP resistant to fraud or manipulation. Specifically, the exchange has not assessed the possible influence that spot platforms not included among the index’s constituent Bitcoin platforms would have on Bitcoin prices used to calculate the Index.

To see if the above issues exist and whether manipulative acts are possible within the ETPs listed in the European markets, historic data (from Google Finance) of the following three ETPs listed in SIX Swiss Exchange are compared with Bitcoin spot price from exchanges (data from Cryptowatch).

- WisdomTree Bitcoin ETP (BTCW-USD)

- 21Shares Bitcoin ETP (SWX:ABTC-USD)

- Coinbase Physical BTC ETP (SWX:BITC-USD)

Correlation between Bitcoin ETPs and spot price suggest price disparities exist

As described in the proposal by BZX Exchange, the index calculation will be based on the volume-weighted median price (VWMP) in the previous five minutes from five exchanges — Bitstamp, Coinbase, Gemini, itBit, and Kraken.

In a very simple and basic attempt to replicate the index calculation with best efforts, daily spot price from four out of the five aforementioned exchanges — Bitstamp, Coinbase, Gemini and Kraken are used.

Since the Bitcoin ETP price scale is often different from Bitcoin spot price, daily percentage change (or daily return) is used in all charts for easy comparison of price disparities.

The graphs below show the daily return comparison between each of the three ETPs and the aggregated Bitcoin spot price, calculated from the four exchanges using the volume-weighted median method.

The left-hand-side scatter plot shows how closely the ETP price is aligned to the spot price. If the two are perfectly aligned, all the points should fall onto the blue dash line. The right-hand-side plot compares the daily percentage return and also plots the difference between the two.

Comparing WisdomTree ETP and the spot, although most of the points in the scatter plot cluster within the +/-5% radius, there are certainly some significant price disparities outside this radius. There was one day during the three-month period that the daily return difference (blue dash line) between the ETP and spot price reached above 10%.

It is also interesting to note that the volatility of ETP price percentage change tends to be higher than the spot. The graph below comparing Coinbase Physical Bitcoin (blue line) and Bitcoin spot (pink line) shows the percentage change of the former could reach nearly 15% whereas the latter only to 10%.

Similarly, 21Shares Bitcoin ETP price is also more volatile than the spot and the correlation with the spot is lower (62%) than that of WisdomTree (67%) and Coinbase Physical Bitcoin (66%).

The price comparisons shown above suggest cross-market pricing differences exist between ETP price and the Bitcoin spot price from exchanges. The price disparities have not been arbitraged away quickly enough to prevent manipulative acts.

However, it is important to highlight that this is only a very rough comparison using the daily data. The difference in prices might be due to different cut-off time each ETP uses to calculate the end of day price, i.e. exchange traded products do not trade 24-hour like crypto spot price; they trade during the Exchange’s regular trading hours from 9:30 a.m. to 4:00 p.m.

Also, in practice a much higher frequency will be used to calculate the index price, i.e.the BZX Exchange proposal suggests to calculate the index price using the previous five minutes data from five exchanges and update the Intraday Indicative Value (IIV) per share every 15 seconds. The analysis done here is only using daily aggregated data to proxy the index price and might not reflect the actual index price using high-frequency data.

It is worth pointing out that although price disparities can be observed between ETPs and spot price using daily data, price discrepancies between the ETPs themselves are much smaller as shown in the graphs below.

It is very likely that these ETPs listed in the same exchange all use the same frequency and cut-off time to calculate their prices, hence the price differences among themselves are smaller. This reinforces the point that the price disparities between the Bitcoin ETP and Bitcoin spot price might come from the frequency and the cut-off time used in the methodology of ETP index calculation, which can not be replicated exactly the same in this analysis.

Spot price disparities between exchanges are minimal

In the first point of concern mentioned at the beginning of the article, the SEC also asked how closely Bitcoin prices are aligned across different Bitcoin trading venues.

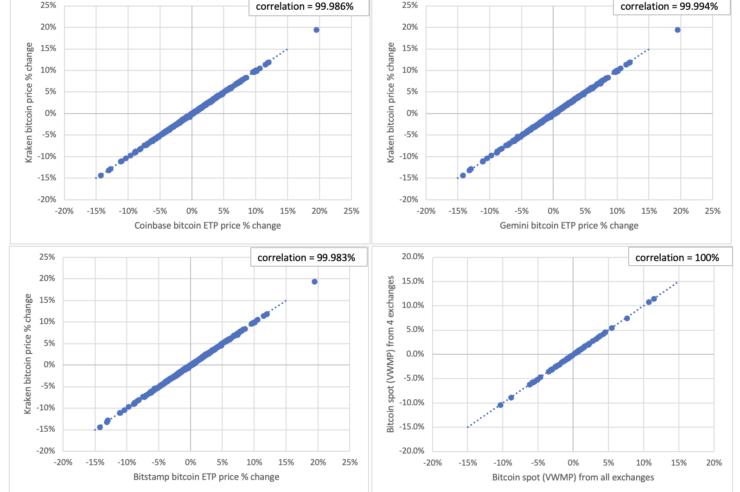

Based on the cross-platform BTC/USD data collected from 18 exchanges from Cryptowatch, the exchange price disparities are very small. As an example to show how closely the prices align to each other, Coinbase, Gemini and Bitstamp are compared against Kraken and the correlation between each pair is very close to 100%.

The SEC is also concerned about the possibility of price influence and manipulation from spot platforms that are not included among the index’s constituents. If Bitcoin prices from other platforms are very different from the 4 constituent platforms (Bitstamp, Coinbase Gemini and Kraken), market manipulators might seek to exploit the disparities for profit.

To see if price disparities exist between the 4 platforms and the rest of them, the bottom right graph below compares the aggregated volume-weighted median price from the 4 platforms with the aggregated price from all 18 exchanges. The nearly perfectly aligned line shows there is almost no difference between the two. The spot platforms do not have large price disparities and the prices are closely aligned across different Bitcoin trading venues.

With such great similarity in daily prices, manipulative acts will be very difficult across exchanges. However, price manipulation could still happen intraday but it’s beyond the reach of this analysis due to lack of high-frequency intraday data.

Based on the analysis from the three SIX Swiss Exchange listed ETPs prices and the Bitcoin spot prices from 18 exchanges, it seems price disparities do exist between ETP and spot. This could potentially lead to manipulative acts towards ETP index price, even though the applicants frequently claimed the sophisticated index calculation methodology prevents such acts.

The SEC’s concerns about fraud and manipulation seems to be justified based on the price disparities between these European listed ETPs and the spot price. That said, the difference could be caused by the daily data frequency used in this analysis, which is different from the high-frequency data used in practice.

On the contrary, no significant price disparities can be found among different Bitcoin trading venues. Although the spot markets from these venues are more decentralised and less regulated than traditional stock exchanges, malicious price manipulation across these platforms could still be very difficult.

Given the large number of centralised and decentralised, regulated and unregulated crypto exchanges out there, it is extremely hard to prove price efficiency and similarity across all of them. The U.S. ETP applicants still have a long way to go to convince the SEC.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments (No)