NFT staking is a promising subsection of DeFi that potentially solves a number of problems when it comes to NFT trading. Above all, it offers NFT holders a chance to earn tokens from their NFTs without ever having to sell, making it an attractive passive income model.

It’s still early days when it comes to NFT staking but considering how much NFTs are growing, and the utility behind NFT staking, it’s easy to imagine that this practice will only become more common in the future. So without further ado, let’s learn about NFT staking and why it’s worth taking note of.

What is NFT staking?

We previously mentioned NFT staking in our guide on NFT passive income guide but we’re going to go into a bit more depth here.

In essence, NFT staking is when you “lock up” an NFT either through that NFT project itself or on an outside platform. In return for staking an NFT, holders earn what is known as “staking rewards”. Thus, staking NFTs provides a way for holders to earn passive income, and to make money from their NFTs without having to sell them.

Staking is a practice that comes from various cryptocurrencies and tokens, particularly those that use the proof-of-stake (PoS) protocol for confirming transactions (you can read a little more about PoS here). As with NFTs, staking crypto tokens involves locking up tokens for some time in return for passive income via staking rewards.

For PoS blockchains, staking is the vital function that allows these networks to process transactions and stay secure. In addition, staking rewards for blockchains and Web3 platforms usually come in the form of network transaction fees or interest.

Why stake NFTs?

One of the biggest issues in NFTs is the problem of liquidity. That is to say, due to the non-fungible nature of NFTs, selling them isn’t always easy. Indeed, much of the value of an NFT is largely subjective – it’s worth whatever a specific person is willing to pay for it. On the other hand, fungible tokens like cryptocurrencies are much more easily traded as they have a market-defined value relative to both fiat currencies and other cryptocurrencies.

The solution that NFT staking provides is that it allows holders to earn from their NFTs without having to directly find a buyer. In this way, staking addresses the liquidity problem with NFTs.

How NFT staking works

As mentioned above, NFT staking happens much in the same way that cryptocurrency staking does. Of course, there are some key differences due to the nature of fungible cryptocurrencies and non-fungible tokens.

The rewards for staking an NFT will vary, depending on the NFT itself as well as the platform on which you stake it. Nevertheless, in general, staking rewards come in the form of a platform’s native token and are given either daily or weekly.

NFT Staking Platforms

Given that NFT staking is a relatively new idea, there aren’t too many platforms that offer it across different NFT collections. Even so, here are some to check out if you’re interested in staking your NFTs.

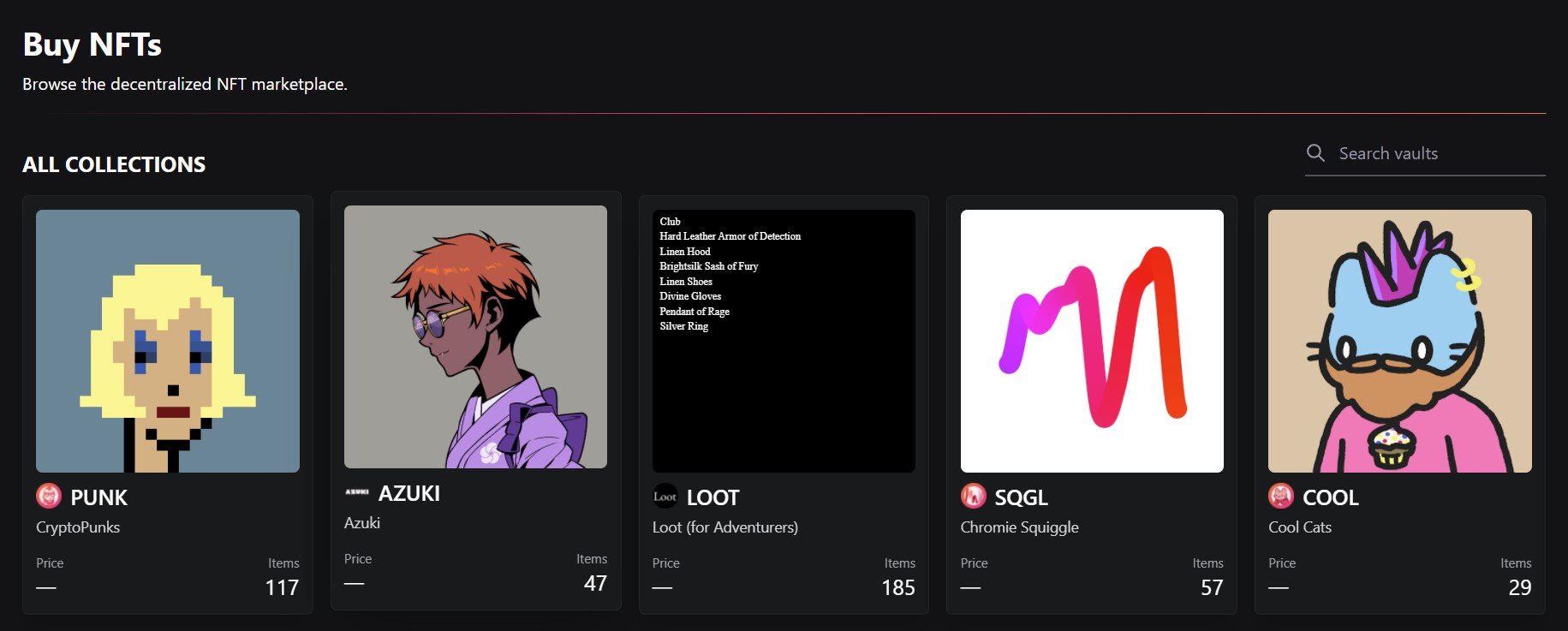

NFTX

NFTX allows holders of certain NFT collections to deposit their NFTs into a vault. In return, NFTX issues an ERC20 token called a vToken. To clarify, this happens as a 1:1 swap. This means that staking 1 NFT in the vault gets you 1 representative vToken. Then, vTokens can be staked to yield rewards, used to purchase other vault NFTs, put into liquidity pools, or sold on decentralized exchanges.

Notably, NFTX recently came out with V2 of its app. Crucially, users can now create a public vault for any NFT that they want. Previously, users could only stake NFTs with existing vaults on NFTX. A full explanation of how NFT staking works on NFTX, along with how to add to the platform’s liquidity pools, is available in the NFTX whitepaper.

KIRA

KIRA is a blockchain that secures its network through a process it calls multi-bonded-proof-of-stake. In contrast to regular PoS networks, KIRA allows users to stake any number of cryptocurrencies or NFT assets. KIRA offers the $KEX token in return for any NFT assets staked, which can then be staked to earn rewards.

Staking directly within an NFT collection

Without a doubt, the easiest form of NFT staking happens within NFT collections that provide this feature directly. Staking NFTs within a collection yields rewards for holders whose NFTs would otherwise sit in their wallets. What’s more, it naturally decreases the supply of that NFT. In theory, this raises the floor price of the NFT collection (as long as demand doesn’t also decrease).

As a result, allowing holders to stake within a collection can be a win-win for both the NFT creators and NFT holders. Staking NFTs is most common in collections attached to blockchain, play-to-earn (P2E) games. Though there are also some non-gaming NFTs that offer staking systems. Let’s take a look at a couple of them.

Axie Infinity

The highly popular P2E game introduced a staking feature a few months ago. Specifically, players can stake the game’s governance token, the Axie Infinity Shards ($AXS). At present, $AXS staking rewards carry an 80% annual percentage rate (APR). This means that stakers would receive nearly double the amount of $AXS they stake over the course of a year.

Splinterlands

Splinterlands is another leading P2E game that includes staking features. Indeed, holders of the Splintershards (SPS) token will need to stake it in order to access taking rewards, participate in governance, or participate in special offers, promotions, and bonuses for SPS holders.

Players can stake SPS either in their Binance Smart Chain wallet or directly through their Splinterlands game account. Although, only SPS holders staking via a BSC wallet will be able to participate in the governance of the game’s DAO. Even so, staking from either place will earn holders staking rewards.

Mutant Cats

While the case with Mutant Cats isn’t so straightforward, it’s worth mentioning. This is because it actually highlights some of the potential issues that NFT projects have when it comes to staking. Indeed, Mutant Cats was one of the rare non-gaming NFTs that allowed users to stake their NFTs for rewards. To that end, holders who stake their Mutant Cat NFTs get rewards in the form of the $FISH token. To explain, $FISH is the token of the Mutant Cats DAO.

At least, that was the plan with Mutant Cats. While $FISH initially represented fractionalized ownership of the DAOs NFT collection, which included 11 Cool Cat NFTs, this is set to change. In short, Mutant Cats had some trouble with its original devs. This led to an entirely new team taking over the project and overseeing the DAO.

On Jan 31, this team announced several changes that will be happening with Mutant Cats as a result. One of these changes is that after consulting with lawyers, they are rethinking the $FISH token entirely. In fact, the team might have to scrap $FISH altogether due to potentially running afoul of securities laws.

Given the Mutant Cats example, it might be fair to say that NFT projects still have a long way to go when it comes to providing fully functional tokenomics and staking models. Nevertheless, NFT staking is an interesting prospect that some collections and platforms have been able to figure out so far.

Are you tired of missing important NFT drops?

Just check out our NFT Calendar !

Subscribe to our hot social media and don’t miss anything else

If you’re old school :

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investments.

Owners, holders, fans, community members, whales… Want to boost this article by featuring it on top of the Homepage? ==> Contact us!

Comments (No)