It has arguably never been easier to participate in the crypto ecosystem. After centralized exchange powerhouse Coinbase recently began allowing its users to deposit part of their fiat paychecks into the exchange in the form of crypto, more people are beginning to realize the potential of the industry and participate in this ever-growing ecosystem.

But, crypto is commonly perceived as fundamentally intricate or lacking the proper interfaces, and whether this is right or wrong, this has been the perception for some time. To some people, the premise of digital currencies will always seem far too complicated. More recently, however, there has been an emergence of easier avenues into the crypto space for those keen to learn more.

It’s important to establish just why people should consider getting into crypto. As with the rest of the world’s industries, digitalization is revolutionizing every facet of our lives. To be able to understand it early on will help more people to comprehend the benefits of this technology in the financial world and become accustomed to a future that will likely heavily feature digital currencies.

Related: Listing frenzy! Coinbase adds nearly 100 crypto assets for trading in 2021

Because of this, making the entry points into crypto as easily accessible as possible should be an endeavor for all developers in the space to consider. But, that’s not to detract from the fact that the industry has come a long way and is continuing to prove why decentralization is the key to a fruitful financial future.

What entry points to crypto are there currently?

The current entry points into the digital currency industry are certainly more easily found than they were as little as a year ago. However, far more needs to be done to ensure that the existing avenues into the space for crypto newbies are maintained, continuously improved and promoted to the right people.

There are tools that not only help you learn about and purchase crypto but also applications that put those assets to work. Yield farming is a relatively easy entry point into crypto: a form of high-interest returns on your deposits that were once perceived as an intricate feature within decentralized finance (DeFi) but has matured into a product that almost anyone can comprehend and quickly start earning on their portfolio. By simply purchasing some tokens, you can stake them into a liquidity or lending pool and let them accumulate value.

Furthermore, we are now seeing a more recently renowned entry point with nonfungible tokens (NFTs). NFTs are “one-of-a-kind” assets in the digital world that can be bought and sold like any other piece of property but may have no tangible form of their own. The space has seen meteoric exponential growth during 2021 with the first half of the year $2.5 billion of sales volume for NFTs alone.

Fundamentally, NFTs are new and quirky to the mainstream. Since they have only come to the attention of mainstream audiences recently, there is plenty of clout and this increases their desirability and demand. The “art” world has seen explosive growth in the NFT sector as digital artists can reach millions of people/customers cheaply and instantly.

Related: 2021 ends with a question: Are NFTs here to stay?

Another reason behind the burgeoning popularity of NFTs is the sense of status they carry. Some NFTs themselves have grown their own cult-like communities such as Crypto Punks and Bored Apes and by owning one you are perceived to be a member of their very exclusive club, not to mention potentially very rich. We are seeing some NFT artworks sell for tremendous amounts, and this is only just the start of a very young ecosystem.

What is the problem with these existing entry points?

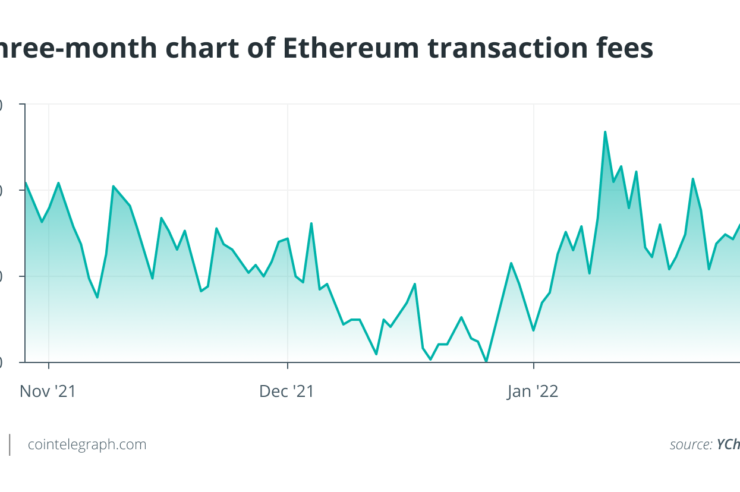

In order to increase the accessibility of crypto, projects have to be able to adapt as things like high gas prices drive people away from the Ethereum network. Because of the nature of these extortionate gas fees, this has driven a lot of projects and users onto other cheaper blockchains like Solana — who recently saw something of an NFT boom with the launch of Solana Monkey Business, Degenerate Ape academy and Meerkat Millionaires Country Club.

Work needs to be done to keep crypto approachable and issues with accessibility, high gas fees and complex UX’s are preventing new users from reaching their full potential. But, more education is needed to help build the confidence of these new users to be able to use these products with conviction and not worry about losing the money that they may have invested into digital currencies.

Related: DeFi picks up the pace as alternate blockchains and NFTs boom

There is discernible progress being made in DeFi that is helping to create more easy access points into crypto, but the NFT space is still a way off just yet. Given the eye-poppingly high prices of some of the most popular NFTs such as Bored Apes and Crypto Punks that have sold for hundreds of thousands of dollars, this is almost acting as a deterrent as those not in crypto are left wondering why on earth people would pay this kind of money for a digital image that can be easily replicated.

This also relates back to the point about education and how NFTs can have utility when implemented appropriately and more people need to realize that. This will come from the NFT projects maturing and demonstrating why these tokens can be valuable and useful in everyday life instead of just solely being limited to a quirky piece of internet art.

What does the future hold for DeFi projects and NFT projects?

In its early phases, cryptocurrencies and blockchain applications were essentially proof-of-concepts and were not so much focused on ease of use. There was less media coverage, the prices of certain currencies such as Bitcoin (BTC) and Ether (ETH) were still relatively low and the focus was on developing these technologies into something viable. But, now after the initial coin offering (ICO) boom of 2017, the DeFi summer of 2020, the rise of NFTs and the soaring prices of BTC and ETH, more people want to learn and get involved with this digital revolution. Whereas before, there was no demand for easily understandable entry points into crypto, but now we are at the cusp of the mainstream population wanting to engage with digital assets.

Related: What’s ahead for crypto and blockchain in 2022? Experts answer, Part 3

One cold hard fact of the digital finance industry is that due to the turbulence and unpredictability of the space, some DeFi projects and NFT projects will last and others will fail. It’s important to showcase the utility of as many projects as possible to prolong their longevity and secure external interest by boosting the number of users, while also underscoring the risks.

Many of the NFTs in the space are immature or are simply an exploitation of the current hype and speculative atmosphere around digital art, leading many buyers into holding digital images that are valueless beyond their visual aesthetic. Digital assets are still intimidating to many people and it is going to take a coordinated effort in education to help digital finance agnostics understand the true value proposition of digital assets. The existing entry points into crypto have a good starting foundation, but we also need more educational systems and support to ensure as wide a reach as possible so that many people have the opportunity to engage with a potential life-changing space.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Redmption, a.k.a “Red,” is a community moderator of Harvest Finance, a DeFi hedge fund aggregator, providing high returns, low gas fees and automated strategies. Red is a sought-after yield farming expert whose insights and opinions appear regularly in numerous international publications.

Comments (No)