Bitcoin has so far been very sensitive to any decisions coming from the Federal Reserve, experiencing massive sell-offs in an aggressive reaction to inflation.

This has prompted many to worry about how Bitcoin will perform in a rate-rising environment, given the fact that the Federal Reserve is considering 4 interest rate hikes in 2022.

While Bitcoin’s performance in the past two months doesn’t look too promising, a recent report showed that its recent sensitivity to inflation is actually an extremely bullish sign.

Rising interest rates force Bitcoin to behave more like other inflationary assets

What will happen to Bitcoin in a market with increasing interest rates?

This is the question the latest CoinShares Digital Asset Outlook report tries to answer.

After almost a decade of unprecedented levels of quantitative easing (QE), the market is beginning to come to terms with the possibility of inflation hitting the U.S. market. This has worried the Federal Reserve as well, forcing it to consider enting the tapering of QE earlier than the market expected.

To curb the inflation they believe will inevitably come, the Federal Reserve is considering 4 interest rate hikes this year, rather than the 2 it originally proposed in 2021.

The last time the Federal Reserve increased interest rates was in 2015, Bitcoin rose by over 51% over a period of six months. With borrowing becoming increasingly more expensive, more people flocked to Bitcoin seeing it as a hedge against unstable markets.

However, CoinShares analysts believe that this time around Bitcoin won’t repeat this pattern.

“We believe Bitcoin has matured significantly since then and is therefore likely to behave differently, and likely in line with other real (inflationary) assets,” the report said.

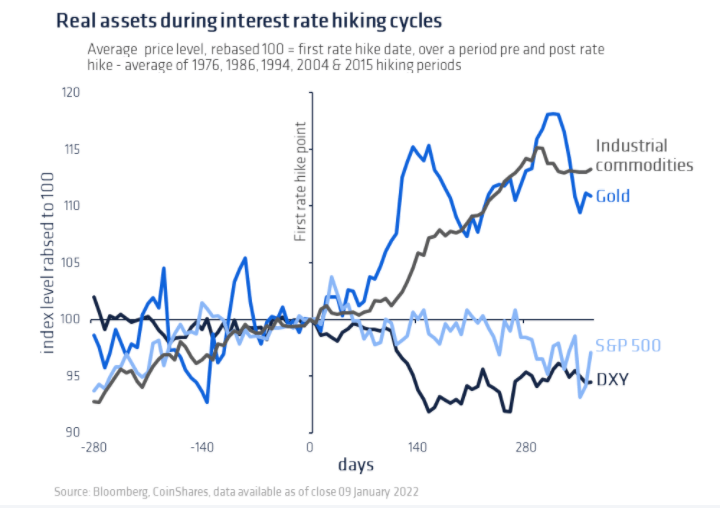

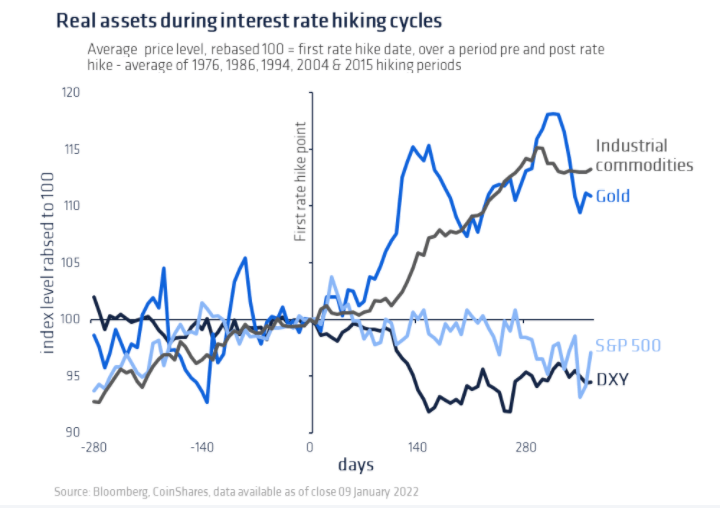

Therefore, to understand how Bitcoin will act we need to look back at how other inflationary assets behaved in previous rate hiking periods.

CoinShares identified five periods that are closest to today—they all saw hikes that followed periods of falling or relatively low-interest rates for a long period. During December 1976, December 1986, February 1993, and June 2004 gold and other industrial commodities all showed surprising consistency in performance.

Being of fixed supply and priced in U.S. dollars, Bitcoin will most likely behave in a similar way to gold and other inflationary assets.

In December 2021 and January this year, Bitcoin experienced a strong reaction to inflation and the increasing probability of more rate hikes, dropping more than 30% from its highs. This means that any upcoming interest rate hike will also cause its price to drop, with every subsequent hike causing a less intense downturn.

However, following a period of downward price swings, Bitcoin will most likely see a significant increase in price. This is in line with how most real assets behaved in similar interest rate cycles, as well as Bitcoin’s inverse relationship with the strength of the U.S. dollar.

Namely, following periods of interest rate hikes, the U.S. dollar has been experiencing periods of extreme volatility and has fallen, on average, by 7% within a year.

As there’s a high chance that the Federal Reserve will raise interest rates too aggressively, CoinShares expects the U.S. dollar to experience a similar selloff this year.

With the dollar losing its power, a big part of the market will flock to alternative assets, with Bitcoin being the clear choice among all cryptocurrencies. Its resistance to censorship and ability to get away from the long arm of the Federal Reserve make it an attractive hedge against inflation. If this was to happen, CoinShares believes that other real assets such as gold will follow suit and see periods of unbridled growth despite raising inflation and the dollar’s downturn.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)