Bitwise, a leading provider of crypto index funds, and ETF Trends, a noted source of news and analysis in the ETF space, recently released the findings of their fourth joint survey of financial advisor attitudes toward crypto.

Financial advisors who manage roughly half of all wealth in the US, are becoming increasingly bullish on crypto.

Advisor engagement in the space is growing

The survey pooled 600 financial advisors, who answered a list of questions on crypto assets and their use in client portfolios.

The results suggest that advisor engagement in the space is growing, as the percentage of those allocating to crypto in client accounts increased significantly–from 6% in 2019, and 9% in 2020–to 15% in 2021.

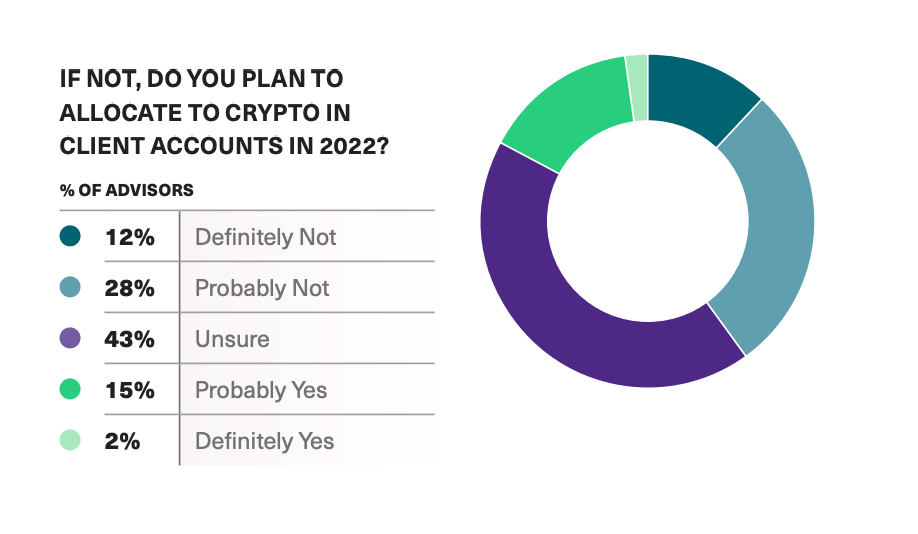

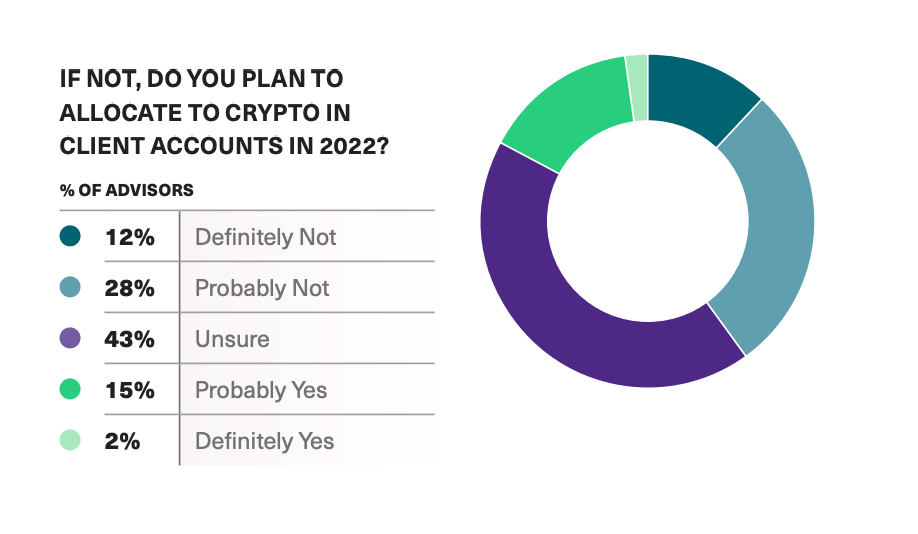

According to the report, an additional 14% of advisors said that they will “probably” or “definitely” allocate in 2022.

Meanwhile, those advisors who currently reported an allocation in client accounts plan to either “maintain” (42%) or “increase” (58%) that exposure in 2022.

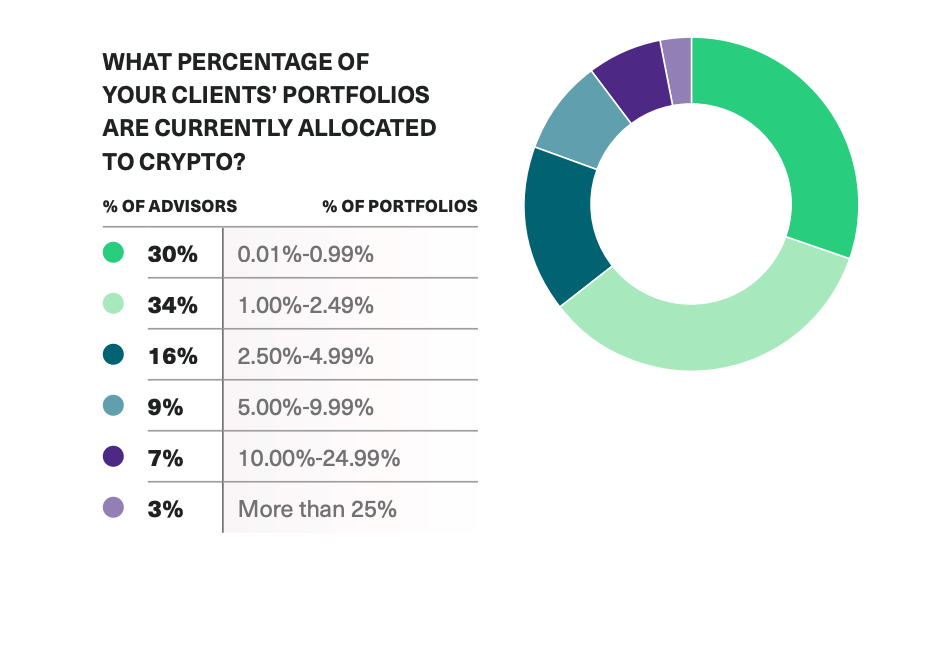

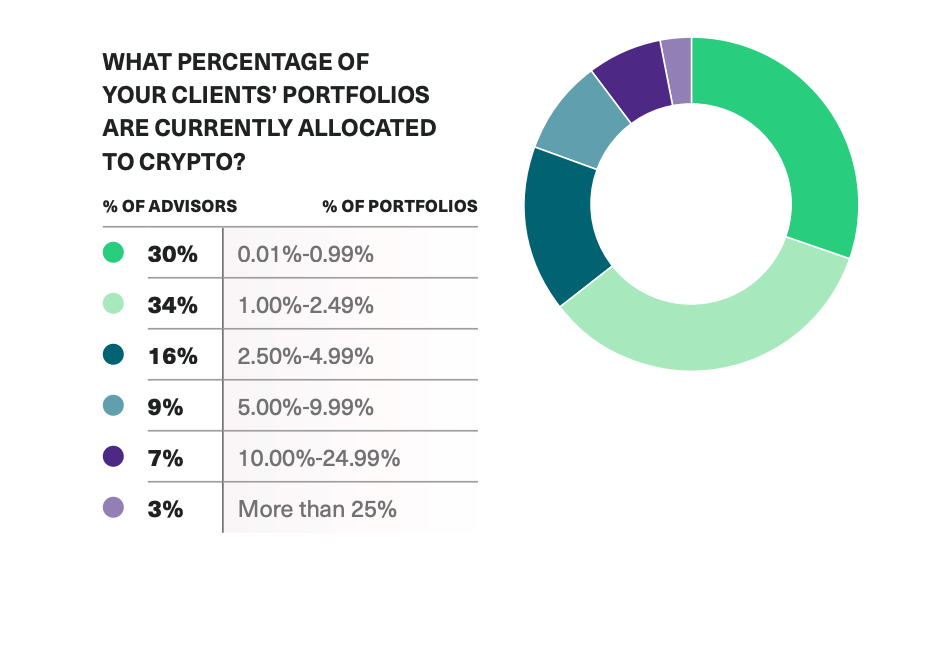

However, 80% of advisors who allocate to crypto in client accounts reported holding crypto at a weight of 5% or less in portfolios.

Interested in finding out how financial advisors are learning about the new market, this year’s survey inquired about the respondents’ primary sources of crypto education.

Roughly the same percentage reported receiving their education from crypto companies (46%) as from traditional media (47%). At the same time, social media surfaced as having less influence, with 29% of advisors referring to it as an educational resource.

Client interest in crypto is also on the rise

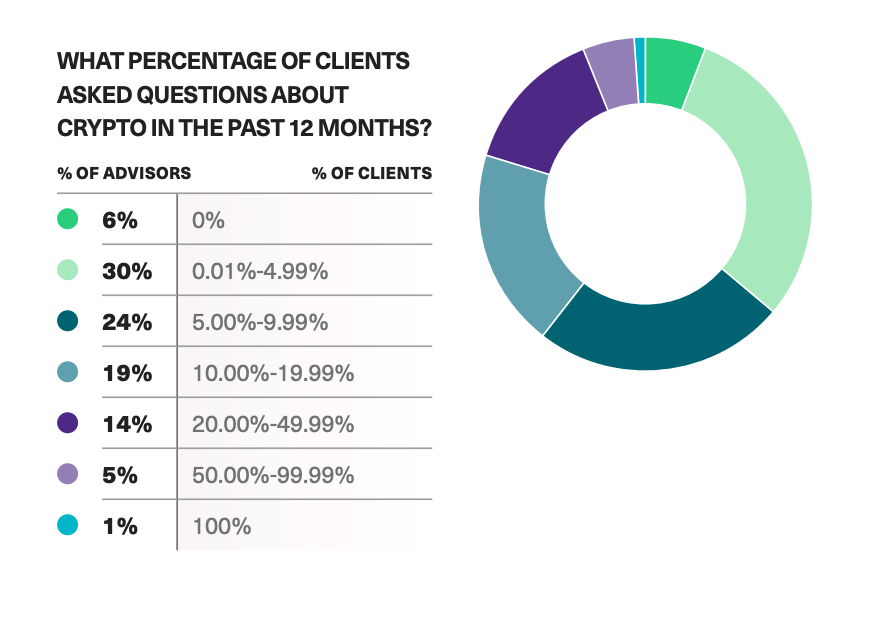

Retail investors’ demand for exposure is clearly on the rise, as 94% of advisors reported receiving questions from clients about crypto in 2021, up from 81% in 2020, and 76% in 2019.

However, the report noted that the majority of clients did not ask their advisors about crypto in 2021–with only 6% of advisors receiving questions from a majority of their clients.

Meanwhile, at least two-thirds of clients (67%) invested in crypto on their own going into 2022, compared to 36% and 35% in the previous two years.

In addition, almost half of all advisors (47%) reported owning crypto assets in their personal portfolios–a sharp increase compared to the prior year’s rate (24%).

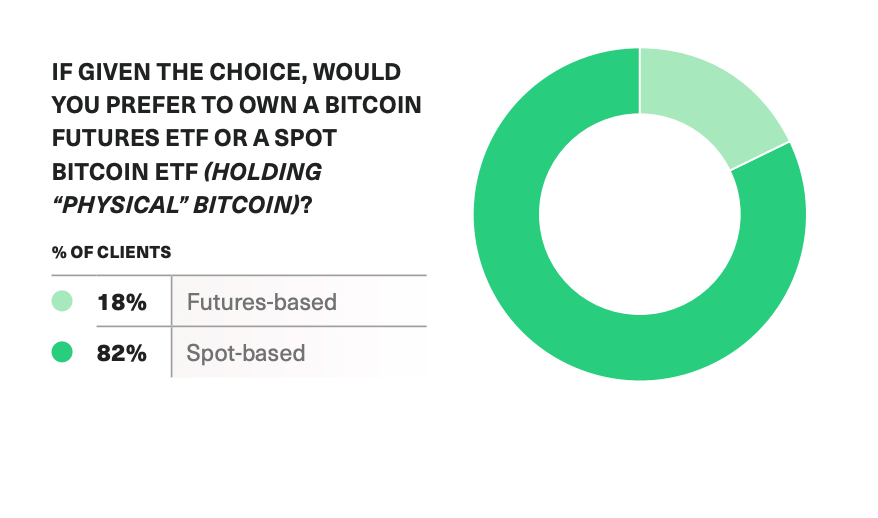

When asked about ETFs, 82% of advisors said they’d prefer investing in a spot Bitcoin ETF, as opposed to investing in a futures-based Bitcoin ETF.

Bitcoin ETFs surfaced as the most appealing investment vehicle, as 58% of respondents stated it would be their preferred way to own crypto. However, the percentage of advisors comfortable owning crypto assets directly increased to 21%–compared to 16% in 2020.

When it comes to equity exposure, the survey revealed the important role stocks play in crypto investing.

An almost equal number of advisors reported interest in allocating to crypto equities (46%) vs. cryptocurrencies–Bitcoin (45%), and Ethereum (41%).

Finally, when asked about barriers, 60% of respondents cited “regulatory uncertainty” as a roadblock to greater crypto adoption in client portfolios, up from 52% in the year before.

Volatility also stuck out as a major impediment, with 53% of advisors stating concerns in that area.

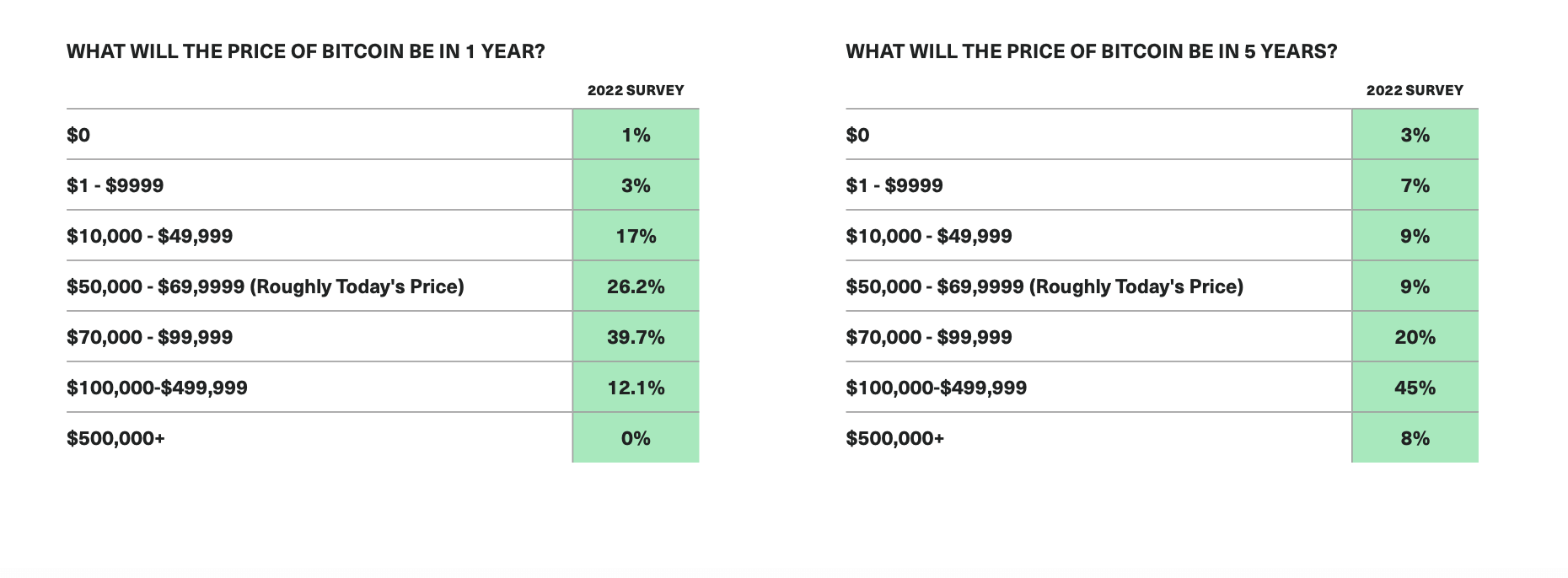

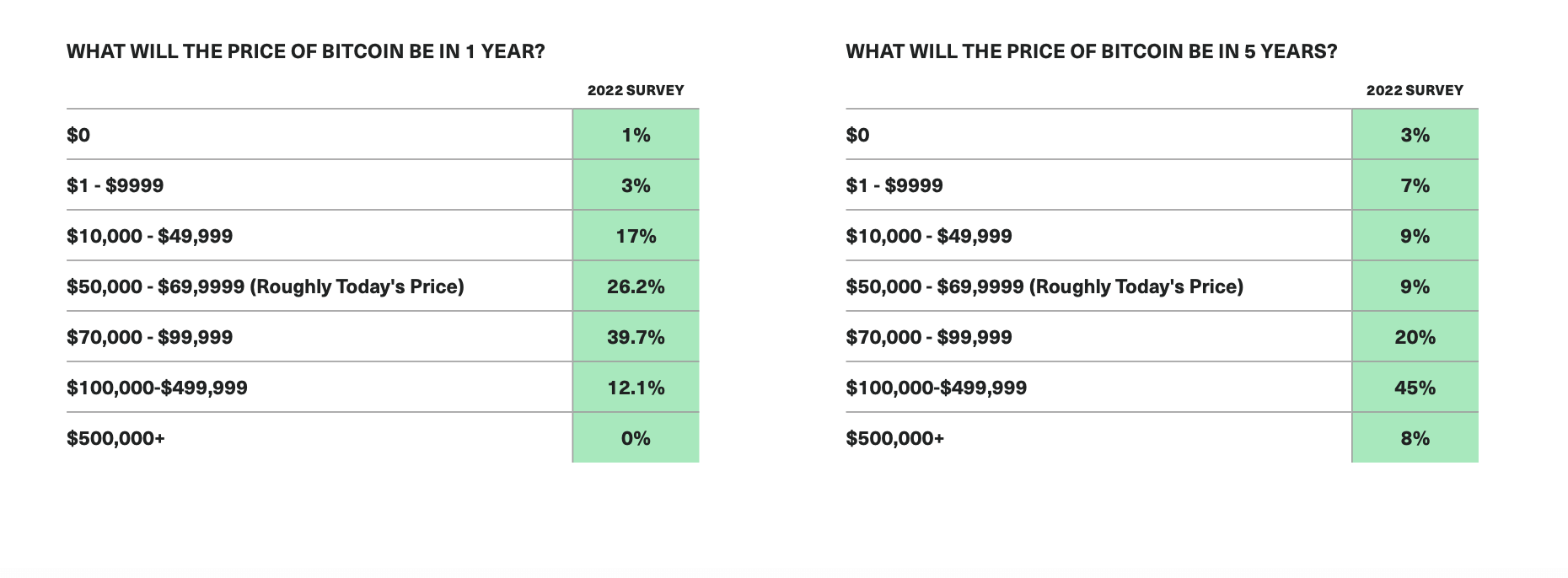

In the end, the survey revealed advisors’ bullish sentiment, as more than half (53%) of respondents expect the price of Bitcoin to top $100.000 within the next five years.

“The fact that so many are so bullish on prices, even as just 15% are allocating to crypto in client accounts, showcases the way regulatory uncertainty, volatility, and other factors are keeping advisors on the sidelines … for now,” concluded the report.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)