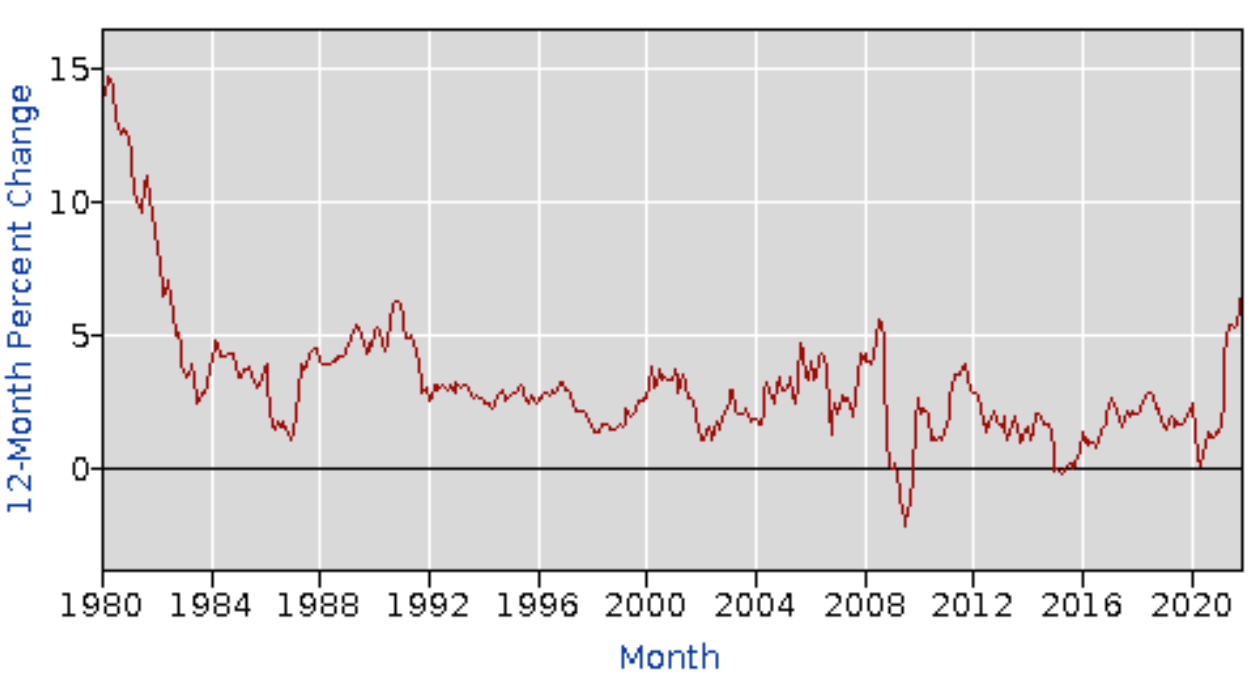

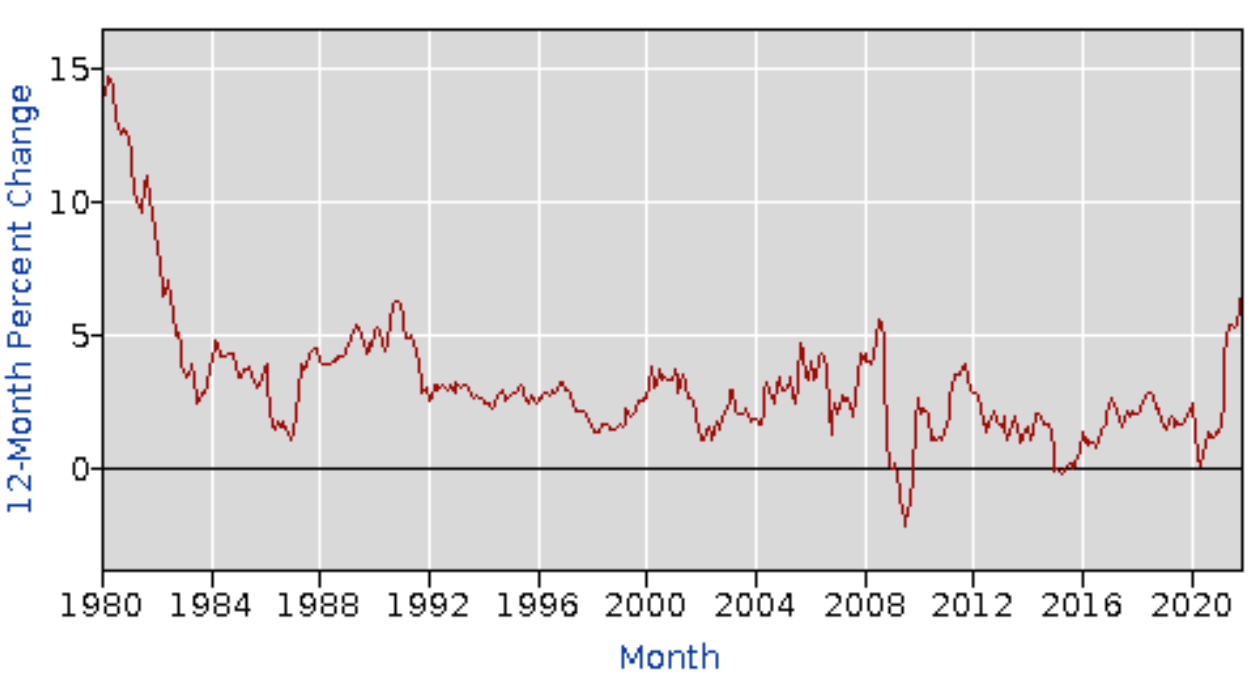

The December Consumer Price Index (CPI) in the U.S. rose to 7.0 percent year-over-year, according to the latest inflation report from the U.S. Labor Department’s Bureau of Labor Statistics (BLS) on Wednesday.

CPI is the most widely used method for tracking inflation. The inflation for December was the highest since June 1982, and rose by 0.2 percent from 6.8 percent in November. On the news of the increasing inflation rate, Bitcoin, often seen as an inflation hedge, trades at almost $44,000 at the moment of writing.

This is a strong movement upwards for the number one cryptocurrency after trading sideways around $42,000 for almost a week. Bitcoin is still down around 36 percent since its all-time-high on the 10th of November last year.

Federal Reserve to raise interest rates

At the same time as rising inflation may be positive for the price of Bitcoin and perhaps other cryptocurrencies in the short term, a push by the U.S. Federal Reserve to raise interest rates, as a means to fight inflation, could make Bitcoin less attractive as assets like bonds might become more attractive.

Federal Reserve chairman Jerome Powell, recently renominated by President Biden, appeared before the U.S. Senate Banking Committee on Tuesday confirmed inflation is still well above target, which is “telling us that the economy no longer needs or wants the very highly accommodative policies that we’ve had in place.” The Federal Reserve has previously stated that given inflation stays at these levels, the market should expect three interest rate hikes this year.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)